Wednesday, June 30, 2010

Required Listening

Delivered in 1994, I think this concise, one hour speech by Ed Griffin remains the single best primer to understand the macro business environment in modern America:

http://video.google.com/videoplay?docid=638447372044116845#docid=-8484911570371055528

Monday, June 28, 2010

Green Exit Strategy

http://www.marketwatch.com/story/tesla-motors-revs-up-244-million-ipo-2010-06-28

Remember, selling to the public happens after the private owners feel they've taken an idea as far as it can go.

Thursday, June 10, 2010

US Government Scrambles to Limit its Oil Liability

http://www.property-casualty.com/News/2010/6/Pages/NFIP-Will-Cover-HurricaneDriven-Oil-Damage-FEMA-Confirms.aspx

WASHINGTON—The National Flood Insurance Program will pay claims for damage to homes and contents from oil driven ashore during hurricanes, its officials have announced.Translation: "We won't cover significant damage from oil."

In a statement, Rachel Racusen, press secretary to the Federal Emergency Management Agency (FEMA), which runs the flood program, said, "The mixing of oil and other pollutants in flood water is not unusual during a storm."

She added, "Damage caused by these pollutants in flood waters is covered under the NFIP, subject to the provisions in the Standard Flood Insurance Policy."

Effectively, Racusen confirmed what Mississippi Insurance Commissioner Mike Chaney told state residents in a statement released Tuesday by his office.

In the statement, Chaney said that to recover damages stemming from the additional risks oil poses should a hurricane strike, claimants seeking payment under the NFIP must prove there is a flood as defined in the standard flood insurance policy.

If that can be proven, Chaney said, damage caused by pollutants to commercial policies is limited to $10,000.

Home and condo payments will be limited to policy limits, and oil or water with oil in the yard is not covered.

Chaney further said that the cost of complying with any local or state ordinance, including one that requires special removal methods for oil, is specifically excluded, with the exception of certain floodplain management mitigation requirements.

Moreover, Chaney said, there will be no coverage for testing for, or the monitoring of, pollutants unless there is a law or ordinance requiring it.

Wednesday, June 9, 2010

How Low Can We Go?

It's easy for human beings to conceptualize the infinite potential for gains. "If I buy this stock for $36/share", we dream, "it could go to $100, then a million, then a billion," and so on..."

Why is it so hard to comprehend the same unbounded realm with regard to loss?

Not comprehending the infinite distance to zero is a critical failure of our human imagination. "If I have a million dollars, that is all I can lose," we rationalize, "my losses are always limited to what I can understand."

That is so wrong.

Your potential losses are just as infinite as your potential gains. If I have an airplane and a boat, and I lose the plane, I am limited to sailing. If I lose the boat but still own my car, I am limited to driving. If I lose my car and have a bike, I am limited to riding. If I lose my bike and own a pair of shoes, I can walk. If I lose a shoe, I will hop. If I lose my other shoe, I will fashion a pair of shoes from scraps. If I can't find canvas, I will use cardboard. If I wear the soles of my feet raw, I will crawl. If...

Astute readers may sense infinite opportunity here, as it pertains to shorting. But the real purpose of this post is to get you thinking about the infinite potential of your life to change, especially if you fail to imagine the possible.

One exercise we should accomplish is to imagine that the money in our wallet represents our last few dollars on Earth. How do we act? How close can we get to that mindset? The closer we can get now, the father away zero will be.

Tuesday, June 8, 2010

PM Update

Anon wrote: Just a question on gold. Perhaps you can point to the right post if already answered this.Why are you expecting a big correction in gold in...

I've addressed PMs quite a lot throughout the blog. My basic position hasn't changed since I went long gold in the early 00's, then jumped off the bandwagon too early in late 2007, still bagging a 300% gain. Yes, I've given back 20% on that position, still on paper, but I'm not worried at all about it morphing into another huge gain. The reason I phased in long in '03 is the same reason I'm short now:

PM prices are driven purely by liquidity.

That's why PM prices act like paper stocks, usually with less volatility. Any genuine change in supply and demand has been dwarfed by an 80+ year sea change of inflating cash liquidity. Since prices deflated to major lows in 1932, the Dow (which in no way reflects individual stock prices) has increased from 40 to 10,000. Gold only inflated from $20 to $1235. Paper stock indexes are a much better inflation hedge than gold.

The quantity of counterfeit cash printed by commercial banks (contrary to popular belief, the US government cannot and does not print money), then laundered into borrowers' names has been plunging since it peaked in late 2007. There are NO signs of that letting up. To the contrary, prices ushered in by The Great Recession still dwell near all time highs. Our Depression hasn't even started rolling, it is in its infancy.

As liquidity dries up, precious metals, nothing but dead metal to reflect the amount of paper in circulation, get priced lower. The outcome is as certain as prices rising during inflation of the cash supply. The timing of the macro price decline is more difficult, as this event big is far bigger than our lifetimes, thus, day-to-day price movements are anyone's guess. But with W3 down maturing, my goodness, you have to LOVE the opportunity to short any asset still clinging to all-time price highs.

So I think gold presents a unique opportunity to capture 100% of the coming depression price declines, the single place you can still jump into an empty bandwagon. Although silver is almost 70% lower than its all-time highs, I think its emerging duality as a precious/industrial metal makes it an even more attractive short, as industry tanks hard.

Thursday, June 3, 2010

Twice in a Lifetime

At Dow 14,000, I described the situation as once in a lifetime opportunity to get short. That was the beginning of W1 down. Here we sit at W3 down, the most devastating wave, and it's Deju Vu alloveragain. Some will ask: How can you be so sure this is W3 down? Didn't it take longer than expected to develop?

The answer to question 1 is, you can never be sure, but it doesn't get much better than this. We had a crippling mega 5-wave down to kickoff our colossal bear, followed by a perfect 62% retrace.

The answer to question 2 is, the most common W2 retracement, especially in a major degree movement, is 62%. It's hard to argue with nature on that basis. The W3 down that follows should be unmistakable and devastating. Again, it's hard to argue that an "inexplicable" 1,000 point cliff dive isn't a suitable W1 of W3.

Accenture lost their entire $30B market cap in a matter of minutes, as the stock dove from $44 to $0.01 and stayed there for several minutes. Most of the shares changed hands from heavily vested owners to traders, some with little to no cost basis. Mind you, this is a "recession proof" stock with 60% of its 170K employees located overseas, with years of extreme growth under its belt--a little like the sewing machine stocks of the late 1920s (see first quote below).

That market malaise took days to sort out. Still, no one knows how to properly handle many of the transactions. Parallels to the death throws and two year collapse of the "Big Bull Market" (so it was called in 1929) are unmistakable, but no one wants to say so out load. Before "the glitch," which was simply an absolutely accurate manifestation of market value met with late, dozing government intervention, every scholar on the face of the Earth would have testified under oath it was utterly impossible to overwhelm our modern trading system.

In fact, as many Black Swan'ers have pointed out the past several years, modern complexity = ever-increasing market fragility. Speed of light trades that travel through the dark of night are, of course, infinitely less robust than a paper system with some form of physical tracebility.

I'll close with the wisdom of dead people:

"To give one single example: during the bull market the common stock of the White Sewing Machine Company had gone as high as 48; on Monday, October 28th, it had closed at 11 1/8. On that black Tuesday, somebody--a clever messenger boy for the Exchange, it was rumored--had the bright idea of putting in an order to buy at 1--and in the temporarily complete absence of other bids he actually got his stock for a dollar a share! The scene on the floor was chaotic. Despite the jamming of the Communication system, orders to buy and sell-mostly to sell--came in faster than human beings could possibly handle them; it was on that day that an exhausted broker, at the close of the session, found a large waste-basket which he had stuffed with orders to be executed and had carefully set aside for safekeeping-and then had completely forgotten."

...

"Coolidge-Hoover Prosperity was not yet dead, but it was dying. Under the impact of the shock of panic, a multitude of ills which hitherto had passed unnoticed or had been offset by stock-market optimism began to beset the body economic, as poisons seep through the human system when a vital organ has ceased to function normally. Although the liquidation of nearly three billion dollars of brokers' loans contracted credit, and the Reserve Banks lowered the rediscount rate, and the way in which the larger banks and corporations of the country had survived the emergency without a single failure of large proportions offered real encouragement, nevertheless the poisons were there; overproduction of capital; overambitious (expansion of business concerns; overproduction of commodities under the stimulus of installment buying and buying with stock-market profits; the maintenance of an artificial price level for many commodities, the depressed condition of European trade. No matter how many soothsayers of high finance proclaimed that all was well, no matter how earnestly the President set to work to repair the damage with soft words and White House conferences, a major depression was inevitably under way.

Nor was that all. Prosperity is more than an economic condition; it is a state of mind. The Big Bull Market had been more than the climax of a business cycle; it had been the climax of a cycle in American mass thinking and mass emotion. There was hardly a man or woman in the country whose attitude toward life had not been affected by it in some degree and was not now affected by the sudden and brutal shattering of hope. .With the Big Bull Market zone and prosperity going, Americans were soon to find themselves living in an altered world which called for new adjustments. new ideas, new habits of thought, and a new order of values. The psychological climate was changing; the ever-shifting currents of American life were turning into new channels.

The Post-war Decade had corne to its close. An era had ended."

http://xroads.virginia.edu/~hyper/allen/ch13.html

Oilcanes

How long are we going to wait to evacuate people residing in coastal regions from Texas to Florida? Do we even have an estimate of the deaths and damage that will result from the first oilcane?

Wednesday, June 2, 2010

PW Update

With the recent market tumble and the mini spike in PMs, my VSE portfolio was zero % return as of PM opening prices this morning (worth 102K/100K, or +2%, but close enough). So, given Marketwatch.com VSE's inability to fix a reverse split of 1 for 10 on a short position, I took this opportunity to eat a percent or two; it is time to adjust my portfolio anyway. PW should work from here forward.

Sunday, May 30, 2010

Terror in the Gulf

As soon as news of the gulf oil spill became public, the Russians suggested the only way to stop it was by nuclear detonation on the ocean floor. A suggestion met with skepticism, at best.

First, it seemed odd, to me anyway, that the Russians had any opinion at all, let alone such a quick and controversial response to a problem few understood, perhaps no one. Or, perhaps someone. As the more ominous nature of this spill takes shape, let us wonder openly about a few things:

How many accidents happen where there can be no reasonable establishment of causality? 1 in 100? 1,000? Is there even a way to estimate the un-likelyhood? Even an asteroid strike can be assigned certain cause, a well understood risk lurking in the heavens.

How many oil rigs spontaneously combust?

How many of those gush at the ocean floor, a mile down?

How many of those create a pool of oil in the middle of the most famous hurricane landing point in the world, which also happens to be upwind of the most envied country in the world?

How many of those can amass a giant pool of oil from leak to beach, without leaving enough time to clean it up, just before the beginning of hurricane season?

Not many.

Let's assume the only way to relieve such a deep gusher is by re-drilling next to the site, an act that cannot be physically completed in less than several months. Let's assume such timing is well understood. Let's ponder the potential wreckage of several times the current spill, being repeatedly blanketed atop the southern and eastern United States.

Freak accident? I think the odds against it. Let's pause before taking that all to timely Russian advice.

Saturday, May 29, 2010

Economic Breakdown

In USD: Shape of things to Come I posted the following:

At the time, I pointed out that the US Dollar has been in a raging bull market for almost two years, a belief shared by, well, no one!

So equating that EW fractal forecast to today, here we sit, on the naked edge of the most ominous economic disaster in human history:

Those who understand this blog know that our dollar's unprecedented, years-long bull market, against all other major currencies, has nothing to do with US economic strength. Rather it has everything to do with US economic weakness. There is no "flight to safety." There never is. What there IS is a collapse in lending from US consumer credit exhaustion, and that has drying up the US dollar supply since late 2007. The collapse of US cash supply is what spikes the value of surviving dollars.

Less bank-printed cash sloshing around to compete for assets, means prices will continue to fall, and the fractal indicates a massive spike in $ value looms in our immediate future. That means falling prices denominated in dollars and an acute spike in bank failures. Less US cash in circulation also means each surviving dollar will buy more foreign currency, sending the Euro and EU into a graveyard spin from which it will never recover (not in our lifetimes, nor our children).

The purple arrows, above, show a rough fractal equivalency. Will the EU collapse very soon? Yes. Is it the fault of the EU? Absolutely. They are fully linked to US economic activity due to a stagnant, predominantly socialist economy. But as the world tumbles into the abyss, it is important to understand that the economic driver of the EU's demise is a lack of US bank-printing/lending, eradicating US and thus world-wide liquidity.

Hold on. Sell assets for dollars while you still can (especially unload precious metals). Avoid large banks, especially Bank of America. Hoard US cash and treasuries.

If EVER there was an appropriate time to unleash the fury of Cashzilla, that time is now:

![[$zilla.png]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEj9Fsw6BzwIbEIsnYmcZouOhEw-9sIXkWeyYVVbmdOLjfw4-8sP2REwSExruk9LO1QkaHuIf_rMCRNFE3Bun4ztl8un8XeuBE0RoBGUnbIQv3V_3XJl6ikRjX4mWy88sZwHiqQPypSGDg/s1600/$zilla.png)

Friday, May 21, 2010

Quick Update

Each time I take a trip it seems to be a market top. No change to the outlook. Will return in June and will try to get out an update before then.

My active Dow forecast remains unchanged (see Open Market Forecasts, below), Dow 3,800 by 2012.

On a side note, Portfolio Watchers will need to some manual calcs. Marketwatch VSE is unable to fix a 1 to 10 reverse split for one of the portfolio ETF symbols. I'll probably move it to a new site, but there is no change to the core stock positions. I updated the overall portfolio percentage on the blog by xls calculation.

My active Dow forecast remains unchanged (see Open Market Forecasts, below), Dow 3,800 by 2012.

On a side note, Portfolio Watchers will need to some manual calcs. Marketwatch VSE is unable to fix a 1 to 10 reverse split for one of the portfolio ETF symbols. I'll probably move it to a new site, but there is no change to the core stock positions. I updated the overall portfolio percentage on the blog by xls calculation.

Friday, April 2, 2010

Cooking the Jobs Report

If ever there was evidence that government agencies are sensitive to political pressure (no!), todays jobs number is it.

After hiring 1.25M workers for the census (a waste of $22/hour on a political battle unrelated to the original purpose of the census), will the BLS use this opportunity to bury millions of lost jobs that they've been saving up? I wonder....

Any useful job-counting method would show +1.25M this cycle, at least as a starting point. Let's see how reliable and accurate the BLS really numbers really are. The implication of a number that isn't reasonably close to +1.25M is twofold:

1) It shows the true state of the economy, X - 1.25M = R (where X is the BLS' "saved-up" number and R is reality)Of the two, #2 is the bigger problem.

2) It will reveal with certainty that our unemployment stats are cooked

Saturday, March 27, 2010

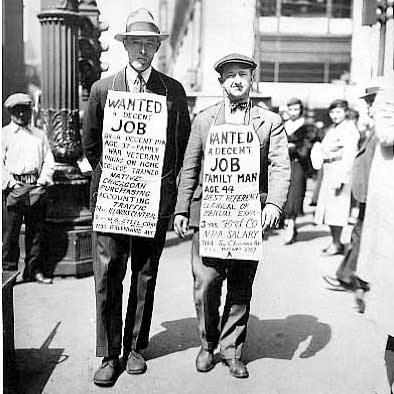

Images of Universal Heath Care

Wednesday, March 24, 2010

ZOOM..... ... . ... . . .. .

From my Nov and Dec 2009 article USD: Shape of things to Come:

And off we go...

In the big scheme of things, time is short. As usual, I recommend a one year (minimum) cash reserve under your own roof, enough to pay all bills and essentials. Keep the rest in a US Treasury account--no longer term than the end of your hard cash and ladder the rest. Simple enough.

There is No Party of No

Marketwatch.com posted another pro-movement piece today, titled "Party of No Fails" cocerning universal health care. My response follows:

There is no "Party of No." Both parties desperately want this and are both part of the ongoing Socialist/Marxist coup.

The Repubs are on the story board to make people feel like they have a voice. You don't.

The predetermined vote margins are an important clue. By barely passing this bill, the Supreme Court (also on the Fed dole--look no farther than Justices now taking their paycheck in private-issue Federal Reserve bank notes--a woefully unconstitutional act) can easily pin the tail on each and every State suing the Federal government as solely responsible for passage in the first place. Nebraska suing up front is a perfect example.

The purpose of flooding the Supreme Court with law suites filed by the same States who were responsible for shoving the bill down peoples throats, is to quickly establish a pro-coup precedent that prevents citizens from taking court action.

Tuesday, March 23, 2010

The Dow Jones Marketing Index

I think some people believe the Dow Jones Industrial Average has something to do with stock performance. That's not exactly the case. The Dow is a sales gimmick, a trick that is played on people to steal their money. Take the following quiz to see if you understand the DJIA:

Directions: Please assume nothing changes exept the Dow components in question, then pick the BEST answer. Don't scroll down until you are finished, the answers are listed below.

1.) If Citigroup stock went to $0 tomorrow, the Dow would:

a. Not change2.) Citi stock goes to $0, at the same time IBM announces a new CEO and rises 4%, the Dow:

b. Drop 360 points

c. Drop 180 points

d. Drop 712 points

a. Goes up

b. Goes down

c. Stays the same

3.) GM was replaced by Cisco on June 1, 2009. On June 2, 2009, Cisco needed to climb ___% to equal the effect of GM's stock plunging -50% just a few days prior.

a. 3

b. 115

c. 50

d. 200

4.) If Microsoft stock goes from $30 to $60 tomorrow, the Dow will climb:

a. 135 points

b. 410 points

c. 40 points

d. 1,200 points

5.) If every Dow component rises $1 tomorrow, the Dow will rise:

a. 240 points

b. 30 points

c. 300 points

d. 90 points

6.) Which relationship is true with respect to making the Dow move:

a. Alcoa + BofA + Citi+ GE + Intel + Kraft + Pfizer = IBM

b. J&J = Kraft

c. Citi + BofA = JP Morgan Chase

d. Caterpillar + Chevon + Disney = Exxon

7.) If a given Dow component falls today:

a. Tomorrow it is weighted less8.) How many of the original Dow components are still part of the Dow?

b. Tomorrow it is weighted more

c. Tomorrow it is weighted the same

a. 0

b. 1

c. 7

d. 12

9.) 3M is 5 times more important than Pfizer.

a. True

b. False

10.) If 3M goes from $82 to $83 at the same time Pfizer goes from $17 to $16:

a. The Dow will not changeI added one more question to clarify a comment...

b. The Dow goes up 50 points

c. The Dow goes Down 50 points

11.) If 15 of 30 Dow components go down 1% per day, and the other 15 components go up 1% per day, after 30 days the Dow would (hypothetically assuming all Dow components started out equally weighted, and the index started at 10,800):

a. Go up to 11,240

b. Go down to 10,400

c. Not change

Answer (a) is always correct.

Sunday, March 21, 2010

Waves of Human Civilization

Anon wrote: "FDRAOA, any chance could you post some longer-term charts showing your wave counts - maybe one showing the count from the market top in 2000 and one that includes the 1930s and maybe even a multi-century one?"

Great question, thanks for asking. I'm not sure a chart would be of much use, since accurate price data is iffy beyond a century or so. But general trends are pretty clear. There are lots of potential very long wavelength EW possibilities and interpretations, so which ones you buy into are obviously up to you.

Wave personalities are important and should align with the time period. As we talk through each set of waves, remember that all (W1-W2)s should be fractally self-similar to the larger degree W12345ABC, of which they form the first two waves.

With that in mind, these are my thoughts. I've never seen EWs dissected quite this way before, but I'm sure it has been thought-through by many.

Biggest picture (the Waves of human civilization):

W1 - Roman Empire

W2 - (Deep Zig Zag) Dark Ages and Crusades

W3 - Renaissance

W4 - (Sideways) Exploration and consolidation of the New World

W5 - Era of Modern Central Bank Looting (BoE counterfeiting model)

WA - Now forming

WB - TBD

WC - TBD

Lesser degree discussion:

In W1, we see a frenzied, extended top that culminates in the severe overconfidence of a single Global Super-Power, the Romans, followed by a total currency collapse as money evolves from hard precious coin to banker-fiat, finally ending in barbaric warfare against an "invincible" professional army; the barbarians eventually win outright.

In W2 we have centuries of lost culture, suffering and famine, seemingly endless wars and unthinkable brutality. W2 is a fractal match to the era we are slowly slipping into today.

In W3 mankind rediscovers culture and civility in an explosion of creativity and scientific competence.

In W4 we explored new worlds and consolidated them into existing economic relationships.

In W5 the Bank of England invents and asserts itself for the purpose of royalties paid by the globally less sophisticated to the lazy, inbred global king pins of a massively corrupt criminal underworld. W5 culminates with the rise and (coming) fall of the modern Federal Reserve system.

Lesser degree discussion:

Let's only talk the internal structure of W5, above, the Era of Modern Central Bank Looting.

W1 of W5 - BoE creates the South Sea Bubble (1694-1725)

W2 of W5 - (Deep Zig Zag) Crash of 1730

W3 of W5 - Economic Rise of New World (America and Far East) (1730-1776)

W4 of W5 - (Sideways) BoE causes American Revolution and plunder of Far East (late 17th century)

W5 of W5 - American Capitalism (1785-ish to 2000)

Let's only talk the internal structure of W5 of W5, above, the fifth wave of the Era of Modern Central Bank Looting.

W1 of W5 of W5 - Hamilton resurrects BoE ties in the form of FBUS/SBUS

W2 of W5 of W5 - (Deep Zig Zag) Andrew Jackson sends BoE packing, all currency is extinguished

W3 of W5 of W5 - Jacksoinan era sparks Industrial Revolution

W4 of W5 of W5 - (Sideways) WWI thru Great Depression (nothing compared to 1836-42)

W5 of W5 of W5 - 1932 to Present

W1 of W5 of W5 of W5 - New Deal socialism sputters (1932-1939)

W2 of W5 of W5 of W5 - WWII (1939-1942)

W3 of W5 of W5 of W5 - Rise of modern American might (1942-late-60s)

W4 of W5 of W5 of W5 - Late 1960s dopers (now in charge of America) thru Vietnam

W5 of W5 of W5 of W5 - 1974-2000 Rise of mega-government-enabled Central Bank Looting

W1 of W5 of W5 of W5 of W5 - Gerald Ford

W2 of W5 of W5 of W5 of W5 - Jimmy Carter

W3 of W5 of W5 of W5 of W5 - Ronald Reagan

W4 of W5 of W5 of W5 of W5 - George Bush I (closet aristocratic socialist)

W5 of W5 of W5 of W5 of W5 - Bill Clinton

After 5 completed movements of fractal degree, all waves reverse and begin their ABC. Note, Wave A may also subdivide into 3 waves, which is my prefereed count.

WA of WA of W5 of W5 of W5 - George Bush II (closet aristocratic socialist)

WB of WA of W5 of W5 of W5 - "

WC of WA of W5 of W5 of W5 - Barack Obama (still unfolding)

...completion of WA bottom, around 2012

There are various ways to interpret the opening stages of the long, grinding collapse of Planet Earth, but it's mostly academic. Centuries-long Dark Ages to follow....

Health Care Bill to Collapse the World Economy

It never stops amazing me how EWs forecast human events so reliably.

Over the past several years, I've been saying that although I don't know what the news event will be, some news event or group of them will collapse the global economy as a tidal Wave 3 down takes hold.

As we sit at the completion of the lower degree W2 of that mammoth Wave 3 down, confirmed in virtually all markets, and yesterday we completed (or nearly completed) an even smaller degree W2 of momma W3 herself, it seems clarification has arrived.

CLICK TO ENLARGE

Saturday, March 20, 2010

First Day of Spring Buries West Texas Under a Foot of Snow

Record snowfall is continuing into Spring as the normally sweltering deserts of western Texas get blasted by another record blizzard.

The Fort Worth Star-Telegram held it's first-ever snowman contest, receiving more than 400 entries. Six received praise:

'Marshmallow Man' look-alike

Erick Thomas and family, Arlington

This snowman had staying power: seven days, to be exact. It's no wonder, at 13 feet tall and 10 feet wide (including the arms made out of 2-by-4's). Thomas, his daughters -- ages 8 and 5 -- and a neighbor worked on this mammoth man in Thomas' front yard for two days.

"We were just making a snowman and decided ... we might as well do it as big as we can," he said. The eyes are made of beer bottles and the mouth is made of charcoal.

It became a neighborhood tourist attraction. "A lot of people stopped by, got out and took photos," he said.

Think tank

Rosalie Kobetich, Lipan

"While passing the commode in our pasture -- which usually is filled with flowers -- the idea occurred to me to build The Thinker," says Kobetich, who is a painter and a member of the Weatherford Art Association. The 5-foot-3 snow sculpture took about 90 minutes to complete by herself and is adorned with a branch of pine needles.

"Unfortunately, he lost his head the next morning because it got pretty mushy out there," Kobetich said. "Too bad he didn't stay longer."

Snow warrior

Jim Walter, Burleson

"This is a statue of a Viking warrior standing on the deck of his long boat, but we didn't have enough snow for the boat," Walter says.

During the snowfall, Walter's family had six different snowman projects going on their pasture, and they were scrambling to complete them before the snow melted. The Viking was his idea. This menacing warrior, holding a spear in his left hand, eventually sunk back into history.

Cold sweat

Michael and Tammie Baker, Fort Worth

"My wife and I exercise together," says Michael Baker. "I run, and she follows me on her bike. We thought that our snow people should reflect our hobby, so we built a runner and a rider in front of our home."

This cardio-tastic snow couple are wearing the Bakers' own clothes and shoes (the race number is from last year's Cowtown Marathon) and using their own bike and ear buds. The hardest part was balancing the one on the bike.

So did they work out after they built their snow avatars? Baker laughed. "That was our exercise for the day."

Snow dragon

Sarah Blaido, Hurst

Sarah, 16, spent three days sculpting this dragon. The home-schooled high-school sophomore "really wanted to do a dragon because it's my favorite thing of all time," she said. She filled up big bins with dense, clean snow and built the rear first, then the middle and front sections. It measured 8 to 9 feet long.

Unfortunately, not many people got to see her creation before it melted. "On the last day, I was just putting on finishing touches when the sun came out, and it immediately started melting," she said.

Global warming protest

Curtis and Melissa Reeves, Weatherford "Thirty snowmen held a global warming protest in Weatherford," the Reeveses said in their clever entry. "The protest ran for two days before the crowd dissipated. No injuries were reported. However, the protesters did leave their signs on our sidewalk."

It took the husband-wife team a few hours to create this snowy scene; each snowman was about a foot tall. It looked especially neat when the candles were lit at night, they said. However, all the snowmen eventually fell victim to the warming trend.

Friday, March 12, 2010

TRADING ALERT: Too Much Liquidity is Your Friend

I've often talked about the evils of Federal Reserve corporation counterfeiting, but sometimes it is your friend. Today's stock market is a good example...

Over the past 97 years, the Federal Reserve has slowly flooded our markets with funny money, creating the greatest global market hyperinflation since the BoE engineered the South Sea Bubble.

Think of modern-day hyperinflation as the water level above an ocean floor. There are features on the floor that the make underlying terrain unique, like a variety of financial different markets should behave, each with its own, independent and characteristic, price behavior. But after you flood the earth with liquid, baseless paper in the metaphor, the water level eventually drowns the interesting features below, and coincident waves of liquid cash create the dominant force driving prices of all markets.

The DJIA is a perfect example of hyperinflation. Since its low of 40 in 1932, the original Dow 30 index has kicked every company out except GE. And yet, this shadow of a ghost, that one-thirtieth of what $40 used to buy, now sells for a little over $10,600. Literally, it takes a wheelbarrow full of worthless paper cash to buy what little remains of the 1932 Dow.

The "evil" part is that the Federal Reserve has sold The People of the United States mountains of this worthless paper in exchange for real assets; those assets are gone (to the Fed's private owners). So what's the "good" part? Why is Fed counterfeiting our friend at the moment?

For the answer, see the chart snippets below. As of today, we sit at the top of a minor W2 of a major W3 in virtually every market. Why do all the counts interlock? $10,600 of pure paper liquidity flooded on top of every $1 or $2 dollars of 1932 value. These counts are dominated by nearly 100 years of mounting hyperinflation.

Proof? Look no farther than P/E ratios, floating almost fifty-fold above the 1932 ratio of 5. That is exactly what you'd expect as the result of hyperinflation.

Am I predicting hyperinflation? No. I am pointing out that it has already occurred. It is the dominant force driving all market prices today.

Stocks, oil, gold, silver, corn, cattle, you name it, and of course, inversely, the dollar--all waves are aligned on this March 2010 morning--and in all cases, a major downward W3 is forming (the USD being reversed: about to explode upward).

Every table is set, or already in breakdown. The charts below are all 3 months long. Minor details are more clear in some than others, but it doesn't matter, if you can count one, you have counted them all.

Idealized Impulsive W1-W2 (downward):

Oil (already in breakdown):

Silver (already in breakdown):

Gold (already in breakdown):

Stocks (about to breakdown):

Fed Accelerates Two Year Cash Drain

Anon wrote: "People are panicking out of the dollar"

0.14% for a 3-Month auction? The line to hold US cash can't get much longer. The money supply continues to drain faster than ever before:

For the past two years the Fed has been sucking dollars out of the system like there is no tomorrow, and there might not be.

Sunday, March 7, 2010

Stock Market Update

A lot of people have asked for an update, so I've taken my stock updates from Jan 2009

...and Nov 27, 2009 (click to enlarge):

And I've appended my new thinking (click to enlarge):

As I've been saying but would like to reiterate, the major W5 on that chart (Wave A bottom) will likely happen in or around 2012. My target for Wave A is Dow 3,800. Time is difficult to estimate, and basically unimportant compared to the price target being achieved.

In other words, if EW's indicate that nature has programmed poker players to stand up and walk away from a poker table after losing $X, it doesn't really matter how many hands it takes to lose $X. That said, we might instinctively read into the same metaphor that time, or the number hands going nowhere, plays some role in the human decision making process.

Friday, March 5, 2010

The 11th Plank Has Arrived

Both congressional Democrats and Republicans (while feigning outrage) want to pass Government Health Care. That's why massive capital gains tax hikes (15% to 22.5%) and income tax bracket hikes (to 42.5%) are buried in the new version of the bill.

For those not following U.S. (over-)achievement of the 10 planks of Marxism:

1. Abolition of private property and the application of all rent to public purpose.

Done.

As we've seen all too well lately, banking corporations are our government. But to the extent some are private, by the time a 30 mortgage is paid, property taxes exceed original mortgage payments.

2. A heavy progressive or graduated income tax.

Done.

3. Abolition of all rights of inheritance.

Done.

The death tax forces all family businesses, of any value, to turn over the keys to the corporate-government for pennies on the dollar when the owner dies. If you own nothing, you are exempt.

4. Confiscation of the property of all emigrants and rebels.

Mostly applied to US citizens through Eminent Domain.

Marx was just an angry racist; the original White Supremacist.

5. Centralization of credit in the hands of the state, by means of a national bank with state capital and an exclusive monopoly.

Done.

6. Centralization of the means of communication and transportation in the hands of the State.

Done.

7. Extension of factories and instruments of production owned by the State, the bringing into cultivation of waste lands, and the improvement of the soil generally in accordance with a common plan.

TVA, Government Motors, more broadly... corporations and our government are indistinguishable. "The United States government will bear any burden and pay any price to ensure that Citigroup does not fail" --Chairwoman of congressional oversight panel

Certainly, more to come.

8. Equal liability of all to labor. Establishment of Industrial armies, especially for agriculture.

Done.

9. Combination of agriculture with manufacturing industries; gradual abolition of the distinction between town and country by a more equable distribution of the population over the country.

Done.

Government zoning has displaced individual land ownership. But I think Marx was probably high when he phrased this one.

10. Free education for all children in government schools. Abolition of children's factory labor in its present form. Combination of education with industrial production.

Done.

And now, beyond Marx's wildest dreams:

11. Centralized control over citizens' physical being. Common enforcement of the ideal size and make-up of the population. Care granted in proportion to production.

What do Dividends, M&A, and Health Control Have in Common?

Anon wrote: "Dividends picking up, M&A for cash picking up, and companies buying their stock proves this market is heading higher FDR"

Dividends heading higher is always a sign the market is going lower. At market peaks, dividends are virtually non-existent at around 2.5%, because people are happy with cap gains--companies don't need to pay cash flow to attract stock trader-speculators.

At major market bottoms (talking Great Depression lows), dividends hover as high as 30% to attract investors (I'm interchanging the term "trader-speculator" and "investor" intentionally). Today we're in the 3-4% range.

Remember the M&A flurry at the last major W2? It was at Dow 11.8K and only a few bears were left waiting, and waiting, and waiting on the market to turn lower. The Bear bandwagon emptied out, just like today. Then the stimulus bill passed and the very minute of the vote was the W2 peak. The market was at 6.5K within a few months.

Interesting that the health care bill is set to pass as early as next week, with little hidden gems like an increase in the capital gains tax from 15% to 22.5%, and a similar income tax bracket increase. Just saying... look out man, it's coming.

Any of these major news events could trigger it. It doesn't matter what the news is, EWs tells us that a major change is imminent and it will be interpreted as a major selling event. The same event would be a major buying event if the wave were on the other foot.

Thursday, March 4, 2010

Gov: We'll Break America to Save Bankers

Reported by Market Watch:

"The sheer magnitude of Citigroup's operations, and the company's history of receiving extraordinary government support, has led this panel to an inescapable conclusion: The United States government will bear any burden and pay any price to ensure that Citigroup does not fail" --Elizabeth Warren, chairwoman of the congressional oversight panel

I guess it is old news that the FDIC has failed and is powerless to insure rapidly imploding $3T Citigroup and their 40x leveraged losses.

The "price" is the wholesale disposal of the U.S Constitution. All to protect congressmen's private IRAs/401Ks, probably amounting to thousands of dollars. And that won't even work.

Run.

Wednesday, March 3, 2010

Prechter's Armageddon

Blogger's comment engine was apparently snagged for a few days. Comments reappeared this morning and are all posted (hopefully). If any are missing, I haven't seen them, sorry.

As readers of this blog probably know, Bob Prechter is the guy who smuggled EW analysis away from the smart money and delivered it to The People in the 1970s.

In the late-30s/early-40s, R.N.Elliott discovered the EW insight, the fractal, and single-handedly unlocked a major part of how Nature works in his astonishing work titled, Nature's Law, The Secret of the Universe. Perhaps more astonishingly, one cannot find RNE's work on the shelves of any Library, or in any book store. If nothing else, the early discovery of the fractal and how nature uses them to generate complexity from simplicity makes this book invaluable to the scientific community. But magically, RNE's highly profitable masterwork had apparently vanished from the face of the Earth.

Bob learned of EW theory as a professional trader in the back rooms of large trading houses, and immediately realized the value of sharing with the world (he located the original on microfilm in the basement of the Met NY Library, if memory serves). To this day, the only way to read RNE's original book is in a back chapter of one of Bob's first offerings (I have no affiliation).

Bob is a brilliant guy with an amazing track record. His first big public call was in 1982, when he predicted that an enormous Wave 4 was now complete (from the mid-1960s to early 80s), and that a massive inflation was coming. He said you could do no wrong investing in paper stocks, almost anything would do. His 1982 chart (with the Dow bobbling beneath 1,000) projected a surge to Dow 4 to 5,000. Needless to say, professionals laughed at him until they wet themselves, after all, we were in a major recession at the Dow had scarcely topped 1K in all of stock market history. When the market surpassed Bob's call in a few short years, he began warning of a major top, the Wave 5 top formation.

"Pro's" drunk on inflation that they were way too stupid to predict, laughed again. Bob was a few years early, the market went crazy, we experienced a final bout of hyperinflation as the ending phase of the 1932-2000 Wave 5 of an even bigger 5 slowly fell into place. But Bob was exactly right. When viewed in the proper multi-century context, that he always framed but few were smart enough to wrap their minds around, Bob's calls will plot within a few pixels of precision.

As the 1990's big bang boomed, Prechter counted out the final form of the mega-top in 2000, accurate within a week or two. Again, an amazing call that few saw coming, and most people laughed so hard they lost everything.

This is when I learned EW theory as a direct result of Bob's work, and not a second too early. Luckily, I had done well as a lemming during the boom, but now I understand it was pure luck. Since then, I've often disagreed with Bob's calls on the margins, but for the most part, the few good EW'ers that are alive tend to agree in the macro.

Recently, Bob issued a warning in July 2007 when the Dow hit 14,000 that Wave B was complete and the mother of all C waves was forming. Again he pointed out that you could do no wrong, by going short this time. He issued a cover call at 6,500 (after I did :) and another short call at the recent peak. Bob is really good, assuming ones understands the inherent risks involved with attempting to call a multi-century top (maybe longer) to the penny.

Bob recently published some free video interviews/updates/warnings on his website. Essential viewing for anyone who doesn't fully understand what is coming:

http://www.elliottwave.com/freeupdates/archives/2010/02/26/How-to-Prepare-Yourself-for--The-Biggest-Bubble-in-History-.aspx

Tuesday, March 2, 2010

Get Ready for a Flurry of Real Estate Activity

The Fed has sold almost the entire Mortgage Backed Security market short. Now it is time to drop it.

Remember, the term "buy" to the Federal Reserve means "sell" to everyone else. They "bought up" the MBS market at prices no one else was willing to entertain (= WAAAAAAAAY too high) along with a scarcely noticed taxpayer guaranty of no losses.

That means when they "sell" the junk, we have to pay their loss. That's right, we have to "buy" it. That means they "sold" to us at WAAAAAAAAY too high a price. Out of the kindness of their hearts, they lent us the cash to buy it too, at interest.

Now, it's time to dump the junk. The lower they price it, the faster they get paid in full. And the faster they start accruing interest on our debt to them, as our cumulative national real estate losses get tacked on to the national debt.

Real estate is about to start flying out of inventory. The inept main stream media will think the Fed has dropped a gift from heaven. "RE Sales UP 200% YOY!!" they'll rejoice, ignoring prices that are deteriorating more than hard-line bears dared to dream.

I've dreamed it. It isn't pretty.

Monday, March 1, 2010

Borrowing to Stay Afloat...

http://www.marketwatch.com/story/goldman-to-sell-2-billion-in-bonds-informa-says-2010-03-01

..."normally" beats selling off assets at fire sale prices, especially when you're carrying assets on your books absurdly above market price. Problem is, borrowing your way out of trouble is only feasible during inflation, during deflation, debt crushes you.

In other words, "fire sale price" is a inflationary term. The equivalent deflationary term is "overpriced."

Saturday, February 27, 2010

Leveraged Losses

It strikes me that a lot of media scarecrows (terrified because, if they only had a brain, they wouldn't be stuck long) think that bailouts will eventually end. That's wrong. They will never end.

The media misunderstanding stems from a basic misunderstanding of leveraged losses. Take Goldman Sachs, one of the most highly leveraged of any surviving gambling saloon. During the reign of an obscure CEO named Henry Paulson, they created the majority of toxic subprime CDOs and insured them through an obscure company named AIG. So far, they've "survived" because they ordered up a $320B government cash infusion. I can't remember the name of the Treasury dude who shoved the money in their pocket in the face of 100:1 citizen opposition, wasn't Hank it somebody?

Pundits think that since they only have around a trillion in debt underpinning, that means their losses are somehow contained to a number in that range. No. Their losses are uncontained, because their leverage is uncontained. And why not? They thought they could purchase a bailout for only tens of millions of dollars in campaign contributions. But there is this little inconvenient truth, one they never understood or fully considered: asset deflation.

The problem is that when you are leveraged 20:1 or even 40:1, which was typical for these gambling shams at peak stupidity, your loss potential levers right along with profit potential:

And so, we see why Goldman ordered congress to cancel Mark-to-Market rules. As long as they don't have to mark any assets down (Goldman has booked almost no write-downs on the largest subprime real estate and toxic CDO portfolio in existence) they can assign phantom value to their asset base. This hides the reality of the loss, until... the great margin call of 2010 forces liquidation. Coming soon, to an "investment" bank near you.

Got a few trillion more, taxpayers?

As a small down payment?

Friday, February 26, 2010

Thursday, February 25, 2010

Welcome to the Land of Oz

Following up on the comments to the last post regarding the classic work of Frank Baum, The Wonderful Wizard of Oz.... ...or, more accurately, the Land of Oscar Zoroaster Phadrig Isaac Norman Henkel Emmannuel Ambroise Diggs...

I was reminded of the book when Rhonda Smith, a scarecrow, sniped in congressional testimony, "Shame on you Toyota for being so greedy!" (which absolutely convinced me that she made the whole thing up and Toyota is being railroaded ACORN-style).

You see, Toyota is a Tinman with a smokestack hat. Stupidly dependent on oil, he has to get bailed out by the common folks. Ah, if he only had a heart...

And if the panic-stricken scarecrows like Rhonda, who freak at the mere thought of fire only had brains, they wouldn't be so easily manipulated...

And if our Cowardly Lions only had the courage to stand up to the establishment, (fill in your interpretation here, but I think it's about duping us into costly wars, happily pledging others peoples' money and lives)...

Then Dorthy could click her free silver (in the original book the ruby slippers are silver) heals and take us home, and we wouldn't arm-in-arm, singing down the yellow brick road to a fabled Emerald City in the wonderful Land of Oz.

Same fears and irritations, 1896.

Bounce Together

kcb comment: "Oil is down 50% from peak, huh? Then why is gasoline here down only 25% from peak?

Food prices are essentially unchanged. If the costs to food suppliers have dropped so much as has been claimed above, why have food prices remained stable?

Why have power prices remained unchanged?

Why are automobile prices essentially unchanged (the Ford Mustang GT price is a good example of this)?

Deflation seems like a fairy tale from here. How do you explain that, FDR?"

One of the main reasons I like this blog is that I can gauge sentiment directly. You can do the same at home just talking to a few people. It's quite amazing, you don' t need a large sample size.

Nature has programmed people to think alike. We "think" we have original thoughts, but frankly, we don't. We all think, feel, and more importantly, react, the same way to the same things at the same times.

Nature has programmed our emotional reactions precisely the same way. We all have same thresholds for taking action. "Ok, I've had enough" goes through millions of minds at precisely the same moment.

How could it be otherwise?

If you want to know how similar your thought processes are to others, just look at another human being. Find one. You can pick them out. They all have 1 core body, 2 big legs, 3 other primary appendages for a total of 5, each functional appendage splits to 3, then to 5, and key divisions within those also occur at Fibonacci's 0.62, 0.38 or 0.5, etc.

My point is, were are products of a very simple (better word: elegant) design. The same ratios also manifest mentally in everyone, probably because they exist physically. Our mental ratios are every bit as standardized. Maybe more so.

We shouldn't feel bad, we are all human and have no way to really understand how similar we think unless the study of EWs and markets reveal it to us. Schools can't teach it. They have been financially-evolved over thousands of years to teach the opposite of this simple truth as gospel, to encourage profitable behavior for powerful, not the students. So like all things financial, we must first un-learn our collective education to discover truth.

Just like lots of gold comments occurred on the blog at the gold top, we have lots of comments expecting inflation now, and that means we've hit a mental threshold. This is excellent confirmation that a new leg has begun.

To answer your qs:

I would say you've proven the opposite, that inflation is a fairy tale. You've shown that prices are lower and falling, given 0% for years now. Showing any amount of price decline puts one in the deflation camp.

Some prices might be unchanged, that's entirely possible in a deflation given a transaction volume decrease, it only takes one person to set a price. Your example of auto sales is a good one, transaction volume is down 50%. Car companies have two choices, let half their people go and build half the number of the same cars at the same price, or drop the price. Both will happen eventually.

In Aug 2007, everyone who is someone knew lower Fed rates were coming (it was incredibly obvious since the 3-M Treasury had dropped from 6% to 3%, and Bernanke was still asleep at 6%--the guy really has no clue). At that time, I pointed out that lower Fed rates ALWAYS foretell lower stock prices, and that there had never been an exception to that rule since the Fed was created. Needless to say, 99% of people reading that freaked, regurgitating what the Fed taught them in public and private schools, that low rates are severely inflationary and that the Fed controls markets.

Boy, were they wrong.

The truth is always simple.

Jim Rogers was correct when he said, "the Fed is irrelevant." They are. Just like any thief, they don't make the money nor do they know how. Or, they wouldn't be thieves.

Fed rates simply follow the market, and they are utterly helpless to control it. Just like everyone else.

Wednesday, February 24, 2010

Deflationary Policies

Anon wrote: "When do you think deflation actually starts to effect things around us. Housing is down but that is like saying the nasdaq is down, it is deflationary to some but not the entirety."

We still have markets teetering lower with various rates and amounts of deflation, but all are solidly deflated:

If you adjust for buying power using gold dollars, the same way they did in 1932, we're down about 85% on average.

Now, one could make an interesting argument that, hey, large asset prices are only down 40%-ish and adjusting for gold dollars indicates a much steeper decline in standard of living. So there is some muting of deflation due to inflationary policies.

To that I respond, deflation is still the dominant force in play, and we've yet to witness the end game. My belief is that this tremendously wasteful, debt laden, irrational fight to alter a very clear realty, only exhausts desperately needed resources . So while the downward spiral is delayed, deflation is ultimately exacerbated by this giant misallocation of resources. So the end result will be more, not less deflation, when we live through the final capitulation at lows most people have yet to imagine. That should take decades given the scale of the market top that is now in place, but there is no formal time requirement. The floor could drop out.

So these "inflationary policies" aren't inflationary at all if they have (1) have failed to stem deflation, and (2) ultimately make the deflation worse.

They are deflationary policies.

We still have markets teetering lower with various rates and amounts of deflation, but all are solidly deflated:

- Housing is down 30% from peak

- Oil down 50% from peak

- Gold down 10% from peak

- Silver down 75% from peak

- Corn down 60% from peak

- Dow down 35% from peak with 10 new components

- Nasdaq down 65% from peak

- S&P down 30% from peak

- Treasury yields are pinned near 0%

If you adjust for buying power using gold dollars, the same way they did in 1932, we're down about 85% on average.

Now, one could make an interesting argument that, hey, large asset prices are only down 40%-ish and adjusting for gold dollars indicates a much steeper decline in standard of living. So there is some muting of deflation due to inflationary policies.

To that I respond, deflation is still the dominant force in play, and we've yet to witness the end game. My belief is that this tremendously wasteful, debt laden, irrational fight to alter a very clear realty, only exhausts desperately needed resources . So while the downward spiral is delayed, deflation is ultimately exacerbated by this giant misallocation of resources. So the end result will be more, not less deflation, when we live through the final capitulation at lows most people have yet to imagine. That should take decades given the scale of the market top that is now in place, but there is no formal time requirement. The floor could drop out.

So these "inflationary policies" aren't inflationary at all if they have (1) have failed to stem deflation, and (2) ultimately make the deflation worse.

They are deflationary policies.

Tuesday, February 23, 2010

3s of 3s Everywhere

Wave 3's are typically the strongest waves of a 5 wave sequence. At varying degrees, we currently see 3s within 3s converging in lots of markets:

- The dollar is embarking on a colossal Wave 3 of 3, up.

- Stocks are embarking on a W3 of 3, down.

- Gold is converging on a 3 of 3, down

- Silver is hitting a 3 of 3, down.

9:20am Update

Market Watch: "An unexpectedly sharp blow..."

Speak for yourselves.

Unrest

WLWT News 5, Ohio:

Hoskins said he's been in a struggle with RiverHills Bank over his Clermont County home for nearly a decade, a struggle that was coming to an end as the bank began foreclosure proceedings on his $350,000 home.

Hoskins said he'd gotten a $170,000 offer from someone to pay off the house, but the bank refused, saying they could get more from selling it in foreclosure. When I see I owe $160,000 on a home valued at $350,000, and someone decides they want to take it – no, I wasn't going to stand for that, so I took it down," Hoskins said.

Monday, February 22, 2010

Liberty vs. Equality

Today, there's a struggle for control between factions that embrace these ideals. In terms of social constructs, 100% Liberty would be unbridled capitalism; 100% Equality would be fully redistributive socialism. For some time, I've wanted to do a piece on the consequences of the debate, in opposition to what is taught in our Equality-oriented schools and universities. So here it is:

- Liberty is unfair to most people, the gap between rich and poor is enormous

- Equality is unfair to everyone

I will illustrate my case graphically, then shut up.

CLICK TO ENLARGE

Sunday, February 21, 2010

FICO

Anyone who has watched Suze knows that your FICO score is the most important number in you life. You should do everything you can to nurture it. It would be really scary not to be able to borrow as much as you "need." Right?

Right?

Right?

You didn't answer right way.

Surely, you agree with Suze that your ability to borrow money and pay interest to bankers is the very definition of success in your life, right? Everyone should borrow as much as they possibly can, that's just the way it is. The more you make, the more you should borrow from banks. Just be certain you can pay them back with all the interest due.

You should tip your banker 5% at Christmas, too, in case you didn't know that. That's what the Queen of England does.

Here's a clue for living easy in a banker-run world:

If your FICO score is 700+, then you're an idiot if you borrow money. If your FICO score is below 700, then you're an idiot if you borrow money.

If you "need" to think about your FICO score, you should never, EVER, borrow money from a bank. Not for a car. Not for a house. And certainly not for school. Never.

Pay yourself the same principal, interest, taxes, and insurance for 10 years, pay cash for a much nicer house, and you're set for life. If you can't wait, save the same payment for 7 years, put 80% down, and no one will care about FICO.

All debt is bad debt. Reject the stupidity.

Saturday, February 20, 2010

More on Federal Reserve Interest Rates

Steven wrote: "A question I would LOVE to have answered is how the fed profits from the spread between the Fed funds rate and 3m treasuries? (Given that the Fed essentially follows the 3m treasury yield)"

Great question, Steven.

Like any for-profit institution, the Federal Reserve bows to the customer when setting prices. So you are right that the market sets the Fed interest rate, and that rate is always close to the auction rate of the 3-Month Treasury Bill. The Fed lends for a shorter term, 30 days, but also at higher risk. If you chart the two rates, the Fed rate always follows the 3-M T's lead.

And like many corporations, especially given their iron-fist monopoly on U.S. cash, the Federal Reserve tries to maximize profits by creating over-supplies of cash with sale prices, or panic shortages at premiums.

But unlike all other forms of private corporations, a central bank, by government decree, has no significant cost basis associated with their product: un-backed paper. Every penny of interest the Fed pulls in is pure profit, minus the expense of printing, which is why they outsource production and anti-counterfeiting costs to the U.S. Treasury and the U.S. Secret Service. Most people don't realize that the Secret Service primary mission is to protect the Federal Reserve system, not the President. In fact, anti-Fed Presidents, like JFK who attempted to replace FRNs with United State-issue Silver Certificates, place themselves in grave danger.

The Fed's large expenses are covered by The People. The U.S. Treasury actually pays the Fed Corporation a surcharge for the privilege of printing their private-issue cash. The tax code exempts Federal Reserve banks from contributing taxes to Americans. In fact, the IRS pays EVERY PENNY of tax income directly to the Federal Reserve as down-payment on the national debt.

"100 percent of what is collected is absorbed solely by interest on the Federal debt and by Federal Government contributions to transfer payments. In other words, all individual income tax revenues are gone before one nickel is spent on the services which taxpayers expect from their Government." -J. Peter Grace, Grace Commission ReportAny check you send to the IRS is endorsed as follows:

"Pay Any F.R.B. Branch or Gen. Depository for Credit U.S. Treas. This is in Payment of U.S. Oblig." (F.R.B. is thinly veiled code for Federal Reserve Bank)Federal Reserve profits represent a pure export of American wealth to their private holders, who are mostly foreigners. G. Edward Griffin's excellent book, The Creature From Jekyll Island (no affiliation), details who they are.

So to answer your question, like any petty counterfeiting operation, the Federal Reserve makes pure profit at any rate. But they still have to sell at or near the market rate, or they won't move cash.

However, as a socialist institution (by that I mean The People absorb their entire cost basis, but are not permitted to participate in gains) sometimes the Fed's most profitable play is to withhold cash and roll up bank assets from induced failures. In that case, like today, they will price paper cash hundreds, or even thousands of percent above the market rate. When the market rate goes negative from resulting panic, the Fed premium is technically infinite. This has the effect of isolating non-cartel banks from obtaining reserves during bank runs--instead of helping, the Fed runs on them too.

As an institution designed to loot America, whatever the Fed strategy de jour, it is ALWAYS designed to do maximum harm to Americans.

Thursday, February 18, 2010

On Currency

fdralloveragain: Could you pleaes break down this post like Im a five year old? I really want to understand this stuff but I am just a public school graduate. I remember that the govt sells Tbills (bonds?) when they want to shrink the money supply. and buys them when they want to expand the money supply. otherwise im lost. Thanks.

Ok, it has been a while. Public schoolers, please take a seat. I will warn you upfront: my class recognizes right and wrong, and there are consequences for failure. So please pay attention, or the system will have no choice but to enslave you.

First, let's get something straight: no one can print MONEY. No one.

No one.

The notion of printing MONEY is silly. No, it's just plain stupid. Anyone who states such an absurdity is headed for a month of detention. MONEY = wealth = stuff you can't print. A house is MONEY or wealth (assuming it's yours and not the bank's), a car that you own is wealth, diamonds and emeralds and sparkling things are MONEY and wealth, as long as other people want them.

All MONEY has one thing in common: it cannot be printed. Think about it. If something can be created as easily as churning it out of a printing press, then it can never carry any real value. So what is this paper stuff we carry around? It is CURRENCY. CURRENCY is not MONEY. CURRENCY is an accounting system for MONEY.

If I write, "I have 2 cows." Then I write, "+1 cow = 3 cows." I have not created a cow.

In the same way, creating more CURRENCY, via accounting entry, does not create MONEY. CURRENCY, or paper, represents wealth so I can account for it and trade it more easily. Unlike MONEY, CURRENCY is easily manipulated, but that has no affect whatsoever on the amount of MONEY in existence.

So, if a counterfeiter comes along and prints his own CURRENCY (since creating MONEY is way too hard), he might deposit his new paper in a bank account. If so, he has successfully manipulated an accounting entry to his favor. This accounting entry entitles him to buy real MONEY. Since he is getting MONEY but did not make MONEY, it follows that someone else must lose MONEY.

Who loses?

His additional CURRENCY circulates. It competes with existing CURRENCY to bid up prices, in this case, very slightly. All things become a little less affordable. Everyone loses a little bit, because he has "expanded the money supply."

Enter stage hard-left:

The Federal Reserve Banking System. Counterfeiters, extraordinaire.

Next thing to keep straight. The Fed is not part of our government. They insist they are an "Independent Fed" meaning, immune from the influence and legal inconveniences of government. Officially, the Fed is a special tax-exempt corporation. They conduct unregulated hiring, firing, profit taking, insurance buying, private book keeping, you know, all the things governments are either not allowed to do, or have no need to do. As a unique cartel of private banking corporations, the Federal Reserve system also has private owners who draw profits.

So what does the Fed do? What is a central bank, anyway.

"Plank 5 of 10:Simply put, central banks buy a certain government's debt. They are the "creditor" to that government, and the government is the debtor. That's another reason they should never be misconstrued as part of the government.

[We must have] centralization of credit in the banks of the state, by means of a national bank with state capital and an exclusive monopoly."

--Karl Marx, The Communist Manifesto, 1848

Indeed, the central bank's interest must be aligned exactly counter to the citizens' self interest, or they could not make MONEY from The People. You probably don't consider yourself buddy-buddy with your bank. You probably don't get invited to their board meetings, or even their private Christmas parties funded by your interest payments. The creditor is not the borrower. The Fed is not the United States.

How do they buy all this debt? Doesn't it cost A LOT of MONEY? Yes, it does. That is why central banks don't use MONEY. They only print CURRENCY to buy government debt. Simply put: they counterfeit what they need.

They really do.

Granted, it's not illegal. Why not? Because congress passed a special law on a voice vote on December 23, 1913, while all but five congressmen where at home on Christmas recess. It is called the Federal Reserve Act, and that Act says it's legal to print currency with no monetary backing. So it is. For them. Not for you.

The Fed prints CURRENCY and with it they buy our Treasuries. The People pay for the counterfeit via a little known phenomenon called price inflation. This is how our government funds deficit spending and avoids direct taxation.

Why does the Federal government do this to itself?

Simple. They get a kickback from the bank. They get virtually unlimited (or so most think) "MONEY" to spend without that politically troublesome "tax hike" thingy. Tax hikes are so, well, inconvenient, and Constitutional. If you have to do that old fashioned taxing thing, people start to revolt, and you can hardly afford any Federal government, and then what? Then the States have rights, and we can't have that messiness, not in a Constitutional Republic like America.

Truth is, it's not spending MONEY it is spending CURRENCY. It creates no wealth when it is printed into existence. It is simply an accounting trick, a transfer of wealth from The People to the private owners of the central bank. It is the same act performed by any petty counterfeiter, legalized, so politicians get a cut. It's an illusion of new MONEY, designed to steal other peoples' real MONEY.

People are often happy about it. After all, their house is magically "worth more" year after year, meaning: the aging structure becomes less affordable. Their income goes up too, but never as much as the sum total of the counterfeit, because everyone must pay the bank.

The really interesting thing is what the central bank does after they print CURRENCY and exchange it for MONEY. I've posted a lot about how private central bankers leverage their MONEY to, "hopefully," make tons more MONEY. The consequences of the word "hopefully" are the key to understanding why we have deflation, instead of inflation, today.

In summary:

The Federal Reserve is not part of the government, but they are closely tied to government: they give politicians kickbacks, or spending CURRENCY without the need to tax directly. The Fed, technically, "buys" the Treasuries required to fund any budget deficit politicians direct, which then becomes part of our kids' national debt. In reality, the Fed isn't "buying" anything, they are selling freshly printed cash, at interest, to politicians who pledge your future work to private bankers.

Most politicians love the Fed. The Fed is the cash store where they go to buy more cash without the need for a tax increase. Since everyone pays for it, no one pays for it as far as our cynical and corrupt politicians are concerned. Inflation is the most inversely burdensome tax in existence, it rapes the poor, but our corrupt government doesn't care because it is a hidden super-tax and so few citizens understand it. And how could they? They are busy working.

And so, the sad irony is that the biggest deficit spenders are the most pro-rich and anti-poor politicians. They fully understand that. But you'd never know it from their rhetoric.

Sorry to get all political, but hardened republican and democrat politicians are thinly veiled arms of ONE party: the Bank Party. There is right and wrong, and that is wrong. Class dismissed.

Subscribe to:

Posts (Atom)