Cashzilla Watch:

On the loose.

![[$zilla.png]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEj9Fsw6BzwIbEIsnYmcZouOhEw-9sIXkWeyYVVbmdOLjfw4-8sP2REwSExruk9LO1QkaHuIf_rMCRNFE3Bun4ztl8un8XeuBE0RoBGUnbIQv3V_3XJl6ikRjX4mWy88sZwHiqQPypSGDg/s1600/$zilla.png)

Stock Watch:

Today's market move was small but significant. Volume effectiv

ely doubled from yesterday. We will see an increasing slide to the downside as Wave 3 of C, the most powerful down-wave of the bear market, takes shape. I expect good downside returns for the remainder of 2009, but the beginning of 2010 should usher in heavier institutional selling.

Gold Watch:

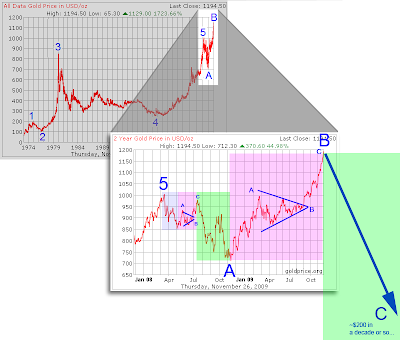

PM prices are being driven by the same liquidity bust as stocks, dying business, and plunging real estate; also causing our sharply rising dollar. Platinum has crashed. Silver is already 10% off its much lower highs from its all-time high of around $50. My 2020 gold target (illustrated below) is so far away in both time and $s that it is hard to estimate in other than broad terms. Gold should hit the previous 4 or slightly lower, in a time frame of a decade or two.

Note 1: EW triangles always precede the final leg of similar degree.

Note 2: The smaller degree A and B waves have been excellent fractal models for the recent larger scale waves. The small green area should provide a similarly accurate smaller scale fractal model for the larger degree C wave to come, which is also shaded green.

Costco Watch:

Black Friday, 7:30pm - No lines; 50% open parking near the door; great deflated prices.

Unemployment Watch:

23% (counting those who've given up looking for work and have dropped off the dole; the BLS number only counts those receiving UE compensation) - We are currently 1% shy of the Great Depression's peak UE rate. Expect peak UE of approx 35%, assuming systemic stability. The "official" BLS number including all unemployed is 19%. 23% results from using the pre-Clinton methodology which is closest to the Great Depression method of simply counting our UE'd.

State Government Watch:

At least 10 States face imminent bankruptcy. They are, in order of total budget shortfall (= annual revenue - annual budget):

- California (-51%)

- Illinois (-49%)

- Arizona (-44%)

- Nevada (-41%)

- New Jersey (-32%)

- Wisconsin (-26%)

- Florida (-25%)

- Rhode Island (-23%)

- Oregon (-18%)

- Michigan (-16%)

- though State 47 are underwater

U.S. Government Watch:

The federal government also faces imminent bankruptcy:

$1.6T annual budget shortfall (-46%)

With UE growing at 1/2M+ per month from only 100M existing federal tax returns, the outlook for any state that is underwater and the federal government is dire.

U.S. Dollar Watch:

As forecast, the dollar is embarking on an rather extreme Wave 3 up, extending it's 21 month march higher (fat blue arrow, below).

Commercial lending, the driver of dollar value, continues to dry up and shut down. So few bank-printed dollars in circulation means each surviving $ buys more and more everyday. Sale prices (= the new permanent price) abound. Investors (as opposed to reckeless capital gains trader-speculators) can't get enough dollars.

Short term T-Bill yields? Nothin.

Look to pay negative Treasury yields within months, as a cascade of major bank failures entice tens of trillions currently placed with shaky banks to fight for tens of billions in Treasuries. Money not already through the Treasury window will be lost.

Real Estate Watch:

As the private Federal Reserve buys up 85% of troubled MBSs for a few cents on the dollar, they can sell the backing assets (homes) for 5% of the 2005-2006 peak price and still double their money. Look for decreasing economic activity to slowly bring this option to fruition.

Would they rather sell for more? Sure. But they essentially have no cost basis for the huge quantities of real estate they are vacuuming up.

War Watch:

Our brave men and women continue to be exploited around the world to generate more egregious spending and thus unlimited interest profits for the debt makers.

It is a weekend to be thankful for the tremendous sacrifices made by our well educated troops, who do what they are told even as many recognize the cancer in Washington DC that uses and abuses them.

It is also a weekend to express outrage to our corrupt politicians of both parties who abuse their sacred covenant with our military. Our men and women signed up to support and defend our Constitution, not to support a $1T drug trade in Afghanistan; not to create a debt generation machine in Iraq; not to fight a faceless enemy to generate a wildly expensive, citizen-bothering DHS nanny state at home.

"War Tax" on the way to help crash markets and squeeze already poor people for more interest cash.

Portfolio Watch:

Portfolio Watch is now a few weeks old and accumulation for the medium-term downside is about set. A Special Report will go out to PW subscribers soon.