Wednesday, December 30, 2009

Extreme Fed Interest Rates Continue to Crush Non-Cartel Banks

Has any government official thought to ask Mr. Bernanke why he has been charging banks between 500% and 10,000% (with momentary spikes to infinity) more for 30 day cash than the longer term 3-Month Treasury rate, since August of 2007?

Are the safest banks in our system really that risky? Or is the Fed trying to make them that risky?

Tuesday, December 29, 2009

Inflation vs. Prices

KCB wrote: "My question is: since the U.S. dollar is now a fiat currency, how can the supply remain low in the face of strong demand? If there's strong demand for a currency, doesn't that imply willingness on the part of those who demand the currency to borrow it? Wouldn't that set up an inflationary scenario?"

It's amazing how many people are convinced that our currency is issued by U.S. government fiat. It's not.

The US$ is issued ONLY by private individuals who hold private equity shares in the private Federal Reserve Bank, and the private banks that lend with leverage on top of their reserves. Think of the Fed as a hedge fund for the world's wealthiest villains. They need the hedge to protect themselves against the greed of one another--much like the mob doesn't keep guns to hedge against police action (they can buy the law), rather,to protect themselves from one another.

To answer your question, it isn't that dollar "demand" is strong relative to the boom years of 1998/1999 or 2005/6, it's not. It is that there are few dollars to be found, so surviving dollars gain buying power.

The Fed is not our banking system. The Fed is a predator in our banking system. They have purchased a government blessing to flood our banking system with reserves whenever they wish to do so, AND when our private banking system is willing and able to arbitrage a low Fed wholesale price of funny-money into additional retail loans with leverage. When that happens, the Fed has a massive inflationary influence, if and when, our banks can reasonably mark up that cash. Obviously, with a 0.04% retail rate for same-term cash, banks are cut off from wholesale Fed counterfeiting--oops, I mean--from profitable Fed "lending."

Right now, the Fed is draining cash harder than they ever have before, by keeping the Fed short term cash price sky high at 0.25%--today it's about 700% higher than the market rate of 0.04%. This is an unmistakable sign that the Fed is trying to seize banks for profit. Suffocating banks under crushing reserve interest rates is not inflationary.

Another perceptual problem arises because some people think inflation means prices. Current price levels have nothing to do with inflation, but for a macro, market-based, cause-effect relationship. "Price" is the toll a trade exacts on the buyer, not a number on a board. Physically trading things, things displayed on stock exchange (the word "exchange" is used for a reason) tickers scrolling at the speed of light, actually takes a pretty long time. Only after the dust has time to settle, and people reconsider how much of something they are willing to give up for something else, is the price, or the toll in goods and services surrendered, truly adjusted at the market or macro level. That's what price means.

Inflation refers to a rise in the dollar supply, not the price level of goods/services when banks print dollars (notice I did not say "the government prints") to arbitrage the difference between their reserve cost and the short term market price of cash. When I use the term inflation or deflation, I'm not talking about prices, because prices in a vacuum have nothing to do with inflation or deflation. Today is a perfect example. Lets take the Dow:

The Dow is down about 40% from highs, -20% from Y2K, and -80% from Y2K when adjusted for buying power (as priced in commodities). This is the macro result of deflation. The best measure is that of long term buying power. The price of the Dow, or the toll exacted in goods and services surrendered, is down 80%. That is the profit one would have made, had they converted Dow shares into other things in 2000 (then bought them back today--which would be a dumb move at the present time).

But, the Dow was up yesterday, so people tend to think there was inflation yesterday. There wasn't, because prices can be set by any number of individuals operating within a greater market. If two people trade a share of the Dow for 50,000, that is the price for that day, but 50K is not a true market price, because two people do not = the market. Institutional sellers cannot fetch that price for their shares, because the one guy dumb enough to pay too much cannot absorb their volume of transactions. Much like the current 10.5K is not the true market price of the Dow, because of the anemic number of transactions we see trading today at that price--not enough dummies.

With near-zero trades, it is possible that the Dow could go to 100K tomorrow. And with absolute certainty, it will return to market value when high volume trading returns. High volume exited stage-left at 6.5K.

Of course, that was a different Dow 30 than we have today--but I think that having to change the Dow 30 is worse than being able to leave it alone, so the true market price is even lower.

Monday, December 28, 2009

On the Verge of Massive Deflationary Implosion

The government's stark acknowledgment the Fannie and Freddie have collapsed is a critical point in our national history. These are the two conduits from which a mountain of flimsy credit was once spawned. Without them, the entire pyramid scheme reverses and falls. The truth is, it has already failed, the chicken's head is in the bucket.

The world economy is on the brink. At any time, C, BAC, JPM, WFC, USB, and GS could fail, and ALL of them will fail. It is a matter of when, not if, the entire global banking system crumbles. That "when" is closer than most people want to believe.

(That was a more interesting prediction when I first made it in 2007, before they had all gone bankrupt once already.)

Friday, December 25, 2009

Merry Christmas To All!

Thursday, December 24, 2009

21st Century: First Decade Recap

As the first decade of the 21st Century winds down, let's reflect on the worst ten financial years of most people's lives.

Despite a sea change at the end of our decade, from centuries of inflation to at least decades of, or perhaps centuries of, deflation, the domestic buying power of the US dollar tubed spectacularly. Over the past 10 years, all central bank-looted major currency pools have become flooded with new and improved, computer generated, extreme high leverage, ultra speculative, taxpayer insured, for-profit private paper issue. The story is much the same in corners of the Earth.

Robbed by the private Federal Reserve banks, our currency has experienced a catastrophic loss of domestic buying power in a single decade:

- Gold buying power fell from $275 to $1100 per ounce, down 4 fold

- Real estate buying power has fallen several fold nationwide, even after sharply deflating

- Oil buying power is down almost four fold, from $20 to $75 per barrel, even after deflating from $150/br

The only bright spot in the opening decade of our Depression has been stocks:

- The Dow has only lost 20%

- The S&P500 is only down 30%

- The NASDAQ is only down 55%

- The Dow is down 80%

- The S&P500 is down 83%

- The NASDAQ is down 89%

Historically stocks are a black hole for public money, that trend has only accelerated in the 21st Century. Unfortunately for most, the worst has yet to be completely imagined.

Wednesday, December 23, 2009

Congress Pinches the Oxygen Hose

As Congress moves quickly to cope with the real inconvenient truth: way too many old people claiming over-promised Medicare benefits, one can only marvel at the raw evil that infests Washington DC.

This blog isn't about the immoral behavior of the maniacally rich men who run Washington for profit, or the financially destitute congressmen who feel they must comply to slave for money, but rather, understanding what is happening so one can survive the money-making impositions made against them.

An interesting question:

Will congressional action to reduce the cost and number of elderly solve the nation's financial problems? On the surface, the answer is clearly yes. Denying reasonable quality Medicare to old people to attrit the bothersome demographic, definitely improves the dire nature of our nation's overextended financial obligations. Some $65T has been promised in Medicare alone, some of that now being pulled by Congress. So on the surface, one would expect the market to react positively to congress's abrupt default on their Medicare promise.

But things are rarely superficial. The bigger question asks what is the sum of the bill's entire impact. If Congress merely cut Medicare payments by shifting the burden to the States, the financial impact (in DC anyway) might be positive. That isn't what this bill does. The bill cuts Medicare, but it does so by socializing the system as the method of policy implementation. So one flip-side to Congress's financially lucrative idea is the loss of our current semi-private health care industry--a serious hit to the economic well being of those permitted by the government to live.

Another clear downside is that financial savings from elderly-reduction are blown twice-over on new pork to keep congressman employed. The net loss of trillions in could-have-been savings is a second serious hit.

A third hit is massive tax increases, imposed for several years before the bill takes effect. And the pork, of course, is instantaneous.

So, immoral as it may seem, the idea of slashing our elderly population makes top-notch financial sense. It makes room for indebted, able bodied workers to toil on behalf of the money power. Unfortunately, as with so many government schemes, it got screwed up by the process.

The economic impact of the government health control required to enforce a politically impossible decision, coupled with the lure of trillions illuminating the eyes of hardened DC criminals, leaves us with the worst of all worlds: dead seniors, lower economic output, and more debt.

Conclusion--our economy will increasingly suffer, even after Moneyed Vultures intentionally suffocate old people to boost their bottom line.

Tuesday, December 22, 2009

S&P 500 EMERGENCY

Source: S&P.com

S&P 500 Price to Earnings ratio:

| 12/31/1988 | 277.72 | 11.69 |

| 03/31/1989 | 294.87 | 11.81 |

| 06/30/1989 | 317.98 | 12.61 |

| 09/30/1989 | 349.15 | 14.74 |

| 12/31/1989 | 353.40 | 15.45 |

| 03/31/1990 | 339.94 | 15.69 |

| 06/30/1990 | 358.02 | 16.84 |

| 09/30/1990 | 306.05 | 14.08 |

| 12/31/1990 | 330.22 | 15.47 |

| 03/31/1991 | 375.22 | 17.92 |

| 06/30/1991 | 371.16 | 19.12 |

| 09/30/1991 | 387.86 | 21.77 |

| 12/31/1991 | 417.09 | 26.12 |

| 03/31/1992 | 403.69 | 24.93 |

| 06/30/1992 | 408.14 | 23.94 |

| 09/30/1992 | 417.80 | 23.16 |

| 12/31/1992 | 435.71 | 22.82 |

| 03/31/1993 | 451.67 | 22.77 |

| 06/30/1993 | 450.53 | 23.31 |

| 09/30/1993 | 458.93 | 22.49 |

| 12/31/1993 | 466.45 | 21.31 |

| 03/31/1994 | 445.77 | 19.63 |

| 06/30/1994 | 444.27 | 17.63 |

| 09/30/1994 | 462.71 | 16.93 |

| 12/31/1994 | 459.27 | 15.01 |

| 03/31/1995 | 500.71 | 15.38 |

| 06/30/1995 | 544.75 | 15.82 |

| 09/30/1995 | 584.41 | 16.61 |

| 12/31/1995 | 615.93 | 18.14 |

| 03/31/1996 | 645.50 | 18.96 |

| 06/30/1996 | 670.63 | 19.21 |

| 09/30/1996 | 687.33 | 19.09 |

| 12/31/1996 | 740.74 | 19.13 |

| 03/31/1997 | 757.12 | 18.82 |

| 06/30/1997 | 885.14 | 21.83 |

| 09/30/1997 | 947.28 | 23.31 |

| 12/31/1997 | 970.43 | 24.43 |

| 03/31/1998 | 1101.75 | 27.86 |

| 06/30/1998 | 1133.84 | 29.10 |

| 09/30/1998 | 1017.01 | 26.70 |

| 12/31/1998 | 1229.23 | 32.60 |

| 03/31/1999 | 1286.37 | 33.52 |

| 06/30/1999 | 1372.71 | 33.46 |

| 09/30/1999 | 1282.71 | 29.18 |

| 12/31/1999 | 1469.25 | 30.50 |

| 03/31/2000 | 1498.58 | 29.41 |

| 06/30/2000 | 1454.60 | 28.02 |

| 09/30/2000 | 1436.51 | 26.75 |

| 12/31/2000 | 1320.28 | 26.41 |

| 03/31/2001 | 1160.33 | 25.54 |

| 06/30/2001 | 1224.38 | 33.28 |

| 09/30/2001 | 1040.94 | 36.77 |

| 12/31/2001 | 1148.08 | 46.50 |

| 03/31/2002 | 1147.39 | 46.45 |

| 06/30/2002 | 989.81 | 37.02 |

| 09/30/2002 | 815.28 | 27.14 |

| 12/31/2002 | 879.82 | 31.89 |

| 03/31/2003 | 848.18 | 27.97 |

| 06/30/2003 | 974.50 | 28.21 |

| 09/30/2003 | 995.97 | 25.82 |

| 12/31/2003 | 1111.92 | 22.81 |

| 03/31/2004 | 1126.21 | 21.66 |

| 06/30/2004 | 1140.84 | 20.32 |

| 09/30/2004 | 1114.58 | 19.29 |

| 12/31/2004 | 1211.92 | 20.70 |

| 03/31/2005 | 1180.59 | 19.57 |

| 06/30/2005 | 1191.33 | 18.80 |

| 09/30/2005 | 1228.81 | 18.46 |

| 12/31/2005 | 1248.29 | 17.85 |

| 03/31/2006 | 1294.83 | 17.82 |

| 06/30/2006 | 1270.20 | 17.05 |

| 09/30/2006 | 1335.85 | 17.00 |

| 12/31/2006 | 1418.30 | 17.40 |

| 03/31/2007 | 1420.86 | 17.09 |

| 06/30/2007 | 1503.35 | 17.70 |

| 09/30/2007 | 1526.75 | 19.42 |

| 12/31/2007 | 1468.36 | 22.19 |

| 03/31/2008 | 1322.70 | 21.90 |

| 06/30/2008 | 1280.00 | 24.92 |

| 09/30/2008 | 1166.36 | 25.38 |

| 12/31/2008 | 903.25 | 60.70 |

| 03/31/2009 | 797.87 | 116.31 |

| 06/30/2009 | 919.32 | 122.41 |

4Q 2009 P/E will likely pop 200.

Objective Conclusion:

The S&P 500 must fall 90% to 95% to reach a price equivalent to 1988 (as far back as S&P's web xls goes). But 1988 represented a valuation in a reasonably strong economic environment, which we do not have today. In 1932, which had much higher Treasury interest rates (the best measure of economic growth expectation) than today, P/E bottomed at 6. To reach that valuation, the S&P must drop by 97% or more, assuming earnings do not deflate at all while the index price falls to almost 0.

Monday, December 21, 2009

The Lost Art of Transparancy

With U.S. corporate-owned-government corruption at all time highs, is anything transparent any more?

Bill O’Neil was born in 1933, the dawn of an inflationary boom from which he'd make a fortune. His investment philosophy was simple: take a stroll down Main Street and see for yourself what is going on.

As we watch deflation ravage Bill's trusty portfolio, devastate corporate earnings and pump major index P/Es towards 200, sometimes it's hard to witness, firsthand, the stress in business offices behind locked doors. But there is one terrific transparent leading indicator that is lit up on signs all over the country: gas prices.

Because gas stations are the last link in a very long supply chain, they need to sell out. So they are forced to charge what ever the masses will pay. Often, you'll see a significant discrepancy between gas prices in the struggling neighborhoods and wealthy sections of the same town.

What are gas prices showing us today?

A nation in deflationary distress:

Bill O’Neil was born in 1933, the dawn of an inflationary boom from which he'd make a fortune. His investment philosophy was simple: take a stroll down Main Street and see for yourself what is going on.

As we watch deflation ravage Bill's trusty portfolio, devastate corporate earnings and pump major index P/Es towards 200, sometimes it's hard to witness, firsthand, the stress in business offices behind locked doors. But there is one terrific transparent leading indicator that is lit up on signs all over the country: gas prices.

Because gas stations are the last link in a very long supply chain, they need to sell out. So they are forced to charge what ever the masses will pay. Often, you'll see a significant discrepancy between gas prices in the struggling neighborhoods and wealthy sections of the same town.

What are gas prices showing us today?

A nation in deflationary distress:

Saturday, December 19, 2009

Prez Returns From Global Warming Conference: Greeted by 10th Worst Blizzard of All Time

Mother Nature can be a cruel witch.

Thursday, December 17, 2009

The CDOs that Disappeared

Not much talk about CDOs these days. Guess we're all glad that's over, right?

Wrong. Oh, how wrong.

The CDO debacle is quietly devastating our real estate market. How? Well, the story goes something like this...

Mr. Potter (I'm in the Christmas spirit) wanted to turn the quaint, snow-covered town of Bedford Falls into a profitable slum called Pottersville. So, he decided to offer every resident a low interest rate home loan they couldn't refuse. Not just the well employed, everyone.

To make money off the un-and-under-employed, he needed a special lending program (don't call it a scheme). So he invented one. He would pool and "securitize" their mortgages. His reasoning was clever, after all, there are strength in numbers. If he grouped a bunch of high risk borrowers into a pool, he could improve the creditworthiness of the whole lot.

Yes, yes, he knows it's a scam. Don't bother him now, he's thinking!

"Let's see," the old man grumbles, "If I pool Uncle Billy with that Sam Wainwright character and old Mr. Gower, we'll, surely, at least one of them will pay me back. Hmmmm, did I just say... surely? Eureka!! I'm rich! I just created AAA paper from a suicidal, drunk old man. I must be brilliant. I'm going to give myself a raise in the morning."

Potter invented the CDO. In doing so, he spun AAA credit from a bunch of junk-quality borrowers, like this: Potter's securities get diced into tranches, one rated AAA, one BBB, and one CCC. An investor purchasing the AAA Tranche of the Pottersville CDO gets the right to hold the last mortgage to default, it might be Billy, or Sam, or Mr. Gower. The BBB investor paid Mr. Potter less, and owns half of the last two performing mortgages. The CCC buyer paid Potter the least, but gets no mortgage cash flow if only one mortgage goes bust. Alchemy at work.

So, what's the problem? Let's count them:

Problem 1) The CDO "securities" trade on the open market and the collective market is smart, not dumb like the original investor.

2) As soon as Billy defaults (we all knew he would), the CCC buyer gets knocked out. That security becomes worthless, it sells for say, 2 cents on the dollar (a pretty realistic figure right now). The problem with Problem #2 is Problem #1. The market is smart enough to know that the AAA tranche also has turned into BBB. And shucks, that BBB paper now sells like it is CCC. Even though the AAA & BBB buyers haven't lost interest cash flow (yet) the price of their paper has plummeted.

3) Impeccably dressed bond insurers have a bigger problem: they charged a rather low premium to insure AAA paper, paper, that is now BBB with an AAA stamp on top. They look the other way. Maybe their problem will go away? It has to go away. That rock solid "insured AAA" paper is backing their pension fund.

4) The CDO remains obligated to pay all three investors. How are they going to manage that? Simple, raise variable mortgage rates on the performing loans. Ooops, after doubling his monthly payment, looks like we lost Mr. Gower to foreclosure. Darn it. Guess that AAA-stamped security is junk too (always was). Hey wait a minute... I know, let's triple Sam's payment and it's all fixed! HOT dog!

As crazy as those problems sound, they're nothing compared to Mr. Potter's grand scheme, a scheme never shared with the dupes who bought his toxic yellow sludge. Potter still has the money they paid him. And Henry Potter just decided something, it's time to buy.

Mr. Potter buys 2/3rds of the mortgages back for oh, 7 cents on the dollar. He leaves the "AAA" sludge for some other sucker, still priced at 42 cents/$1 it's way too high. Potter knows Sam is struggling. He's gonna put the screws to Sam in a minute.

Potter puts his lot of foreclosures up for sale. How does he price them? To sell, of course. As Potter sells off, home prices in Pottersville plunge. And finally, the stress on Sam is too much, he goes under. Potter buys up every house in the town for pennies, then puts them back up for sale.

At least there is one good thing: the CDO debacle is over. They've all been sold off, the losses are booked. Nightmare over.

Or... is it?

Mr. Potter still has homes to sell. Yes, he's ruined Bedford Falls, but he doesn't care. He only has $7,000 in Billy's modest $100,0000 house, now priced to move at $39,000. He's got $14,000 in Sam's $200,000 four bedroom, slap a $59,000 sign on that one. You see, old Mr. Potter can sell at unbelievably low prices and still make a killing.

That's what happens to CDOs that disappear.

Wrong. Oh, how wrong.

The CDO debacle is quietly devastating our real estate market. How? Well, the story goes something like this...

Mr. Potter (I'm in the Christmas spirit) wanted to turn the quaint, snow-covered town of Bedford Falls into a profitable slum called Pottersville. So, he decided to offer every resident a low interest rate home loan they couldn't refuse. Not just the well employed, everyone.

To make money off the un-and-under-employed, he needed a special lending program (don't call it a scheme). So he invented one. He would pool and "securitize" their mortgages. His reasoning was clever, after all, there are strength in numbers. If he grouped a bunch of high risk borrowers into a pool, he could improve the creditworthiness of the whole lot.

Yes, yes, he knows it's a scam. Don't bother him now, he's thinking!

"Let's see," the old man grumbles, "If I pool Uncle Billy with that Sam Wainwright character and old Mr. Gower, we'll, surely, at least one of them will pay me back. Hmmmm, did I just say... surely? Eureka!! I'm rich! I just created AAA paper from a suicidal, drunk old man. I must be brilliant. I'm going to give myself a raise in the morning."

Potter invented the CDO. In doing so, he spun AAA credit from a bunch of junk-quality borrowers, like this: Potter's securities get diced into tranches, one rated AAA, one BBB, and one CCC. An investor purchasing the AAA Tranche of the Pottersville CDO gets the right to hold the last mortgage to default, it might be Billy, or Sam, or Mr. Gower. The BBB investor paid Mr. Potter less, and owns half of the last two performing mortgages. The CCC buyer paid Potter the least, but gets no mortgage cash flow if only one mortgage goes bust. Alchemy at work.

So, what's the problem? Let's count them:

Problem 1) The CDO "securities" trade on the open market and the collective market is smart, not dumb like the original investor.

2) As soon as Billy defaults (we all knew he would), the CCC buyer gets knocked out. That security becomes worthless, it sells for say, 2 cents on the dollar (a pretty realistic figure right now). The problem with Problem #2 is Problem #1. The market is smart enough to know that the AAA tranche also has turned into BBB. And shucks, that BBB paper now sells like it is CCC. Even though the AAA & BBB buyers haven't lost interest cash flow (yet) the price of their paper has plummeted.

3) Impeccably dressed bond insurers have a bigger problem: they charged a rather low premium to insure AAA paper, paper, that is now BBB with an AAA stamp on top. They look the other way. Maybe their problem will go away? It has to go away. That rock solid "insured AAA" paper is backing their pension fund.

4) The CDO remains obligated to pay all three investors. How are they going to manage that? Simple, raise variable mortgage rates on the performing loans. Ooops, after doubling his monthly payment, looks like we lost Mr. Gower to foreclosure. Darn it. Guess that AAA-stamped security is junk too (always was). Hey wait a minute... I know, let's triple Sam's payment and it's all fixed! HOT dog!

As crazy as those problems sound, they're nothing compared to Mr. Potter's grand scheme, a scheme never shared with the dupes who bought his toxic yellow sludge. Potter still has the money they paid him. And Henry Potter just decided something, it's time to buy.

Mr. Potter buys 2/3rds of the mortgages back for oh, 7 cents on the dollar. He leaves the "AAA" sludge for some other sucker, still priced at 42 cents/$1 it's way too high. Potter knows Sam is struggling. He's gonna put the screws to Sam in a minute.

Potter puts his lot of foreclosures up for sale. How does he price them? To sell, of course. As Potter sells off, home prices in Pottersville plunge. And finally, the stress on Sam is too much, he goes under. Potter buys up every house in the town for pennies, then puts them back up for sale.

At least there is one good thing: the CDO debacle is over. They've all been sold off, the losses are booked. Nightmare over.

Or... is it?

Mr. Potter still has homes to sell. Yes, he's ruined Bedford Falls, but he doesn't care. He only has $7,000 in Billy's modest $100,0000 house, now priced to move at $39,000. He's got $14,000 in Sam's $200,000 four bedroom, slap a $59,000 sign on that one. You see, old Mr. Potter can sell at unbelievably low prices and still make a killing.

That's what happens to CDOs that disappear.

Monday, December 14, 2009

TARP -- It's Mr. Short Term Memory! Who?

Anon wrote:

"With everyone paying back TARP, the treasury obviously thinks that the loan losses are done"

Please view the Instructional Video.

Just the opposite--they want to sell high.

Remember, the TARP deal was that the "taxpayers" get preferred stock in the companies to reap the capital gains if the prices went up. That's what "a taxpayer stake" in the company means.

That version of TARP got purged from memory like a bad dream. The "new" TARP idea, since the stocks did go up, is that the banks keep all the capital gains and pay back the principle with market rate interest of 0%, keeping the taxpayers' stake for themselves.

They want out of TARP now, because if they don't sell high they'll lose the taxpayer-funded billions they can pocket and run.

It's just another taxpayer fleecing before the Dark Age the banks see coming more clearly than most.

"With everyone paying back TARP, the treasury obviously thinks that the loan losses are done"

Please view the Instructional Video.

Just the opposite--they want to sell high.

Remember, the TARP deal was that the "taxpayers" get preferred stock in the companies to reap the capital gains if the prices went up. That's what "a taxpayer stake" in the company means.

That version of TARP got purged from memory like a bad dream. The "new" TARP idea, since the stocks did go up, is that the banks keep all the capital gains and pay back the principle with market rate interest of 0%, keeping the taxpayers' stake for themselves.

They want out of TARP now, because if they don't sell high they'll lose the taxpayer-funded billions they can pocket and run.

It's just another taxpayer fleecing before the Dark Age the banks see coming more clearly than most.

Sunday, December 13, 2009

Forget the Savior of Hyperinflation; Bernanke a False Profit

Anon wrote: "Isn't it possible, even remotely, that the dollar might fail? If the government can't sell bonds to anybody and can't pay the bills--declares bankruptcy-- wouldn't that destroy the dollar?"

I hate to be so black and white, but the answer is no, it isn't remotely possible. Cashzilla is back from the Sun, fully recharged (or was that Ultraman?).

The reason is this: in a debt based monetary system, crises strengthens the currency because less paper can be issued upon less credit.

Catastrophe = stronger currency

Prosperity = weaker currency

That is a far worse outcome, a crushing outcome, for most Americans. And that's really why deflation happens, it is an equal and opposite natural reaction to financially whack people who've left themselves exposed to too much debt.

Does it make sense, on any rational level, that a nation drowning in debt would magically be relieved of all private and public obligations? Hyperinflation? All debtors, dream on. Your debts are about to expand in a way you never dreamed possible, as your creditors intentionally cut off your income lifeline, slash the price of your collateral assets, and force you to sell under duress to meet an unmanageable margin call.

Is our government having trouble "selling" bonds? People are lining up to pay negative yields to hold our paper. Demand has never been stronger. Ever. The only time demand for US Treasuries was remotely close to the crises of today was in 1939, when Hitler rolled over Poland. The 3-M Treasury plunged to .04%, its lowest-ever reading until 2008 and 2009, when it registered negative-0.005% at auction.

Do the American people really understand that we are embarking on a journey that our bond market has, by method of global free market auction, determined to be an order of magnitude worse than WWII?

The ONLY way we'll experience hyperinflation is if the U.S. government re-embraces its constitutional responsibility to issue our own currency AND we reject the very same Constitutional mandate to back that issue with copper, silver, and gold. The reason I think that's impossible is because the U.S. doesn't govern itself, private banks, who DO issue our currency, govern every aspect of the United States of America but for a pathetic congressional circus act side-show. Congress is too dumb to understand what currency is, let alone who issues it and how.

Once again, the Lizard ...on the loose.

![[$zilla.png]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEj9Fsw6BzwIbEIsnYmcZouOhEw-9sIXkWeyYVVbmdOLjfw4-8sP2REwSExruk9LO1QkaHuIf_rMCRNFE3Bun4ztl8un8XeuBE0RoBGUnbIQv3V_3XJl6ikRjX4mWy88sZwHiqQPypSGDg/s1600/$zilla.png)

Friday, December 11, 2009

Strong Dollar --> Low Prices

Anonymous said...

Strong dollar is having a positive affect for equities. Everyone was waiting for the DXY to break out to put a chink in the armor of the equity market. The GLD is getting whacked appropriately but it seems that not all paper assets are the same. Would you recommend covering some of my GLD short and leaning harder on the equities short as the two come back together. I presume equities have to come down or GLD has to move up, unless equities are pricing in something I don't see? A stronger economy would support a stronger dollar and thus higher free market bond yields. The government can't handle higher bond yields, so what gives FDR?

Yes, I think equities are pricing in something that you don't see: the dollars used to price them. It makes me chuckle when people say a strong dollar is good for asset prices, it's a little like hoping to be the biggest turkey at Thanksgiving. If the dollar strengthens in buying power by about a penny, stocks priced in dollars fall about 1%. Pretty straightforward.

That said, exchange rates, as opposed to dollar strength or buying power, aren't as straight forward. Exchange rates depict the price of paper in terms of other paper, but that tells you nothing about the buying power of paper itself (see: Deflation and Exchange Rates).

If our current global deflation is a race to the bottom, then the relative positions of the cars represents exchange rates. If the Euro car was in the lead but falls behind, it doesn't matter, deflation still races along; all the cars are speeding in one direction. So the USD's rate of exchange in any given currency, or which car is making a move today, is meaningless to the outcome of a broad currency starvation. A global bonfire is burning bank cash of all domination's.

Most people intuitively understand the benefits of counterfeiting, because they have a debtor's mentality. They never stop to think about burning cash, as an equal or better scam for creditors. Burning cash is easy to do, never suspected, and if you can get enough people to owe you money first, an effective way to collect their assets.

To answer your questions:

No, I wouldn't buy equities. "Sell and hold" until 2012, minimum, still applies. Today, stock prices are about five times higher than record breaking (talking P/E, as the actual price). The macro picture for stocks, and business in general, is dire. Deflation will continue to drain all prices, as has been raging since Dec 2005 (real estate), Oct 2007 (stocks), and March 2008 (precious metals, with a very small-percentage countertrend overshoot in gold being the only exception). Prices are in collapse.

With individual equities, there is a small chance a certain stock price could move against the deflationary trend, but it has to sprint up the down escalator to do so. Rather than focus on finding a stock capable of out-pacing the liquidity squeeze, just diversify short. Diversification is the name of the game when you are trying to play an inflationary boom or the resulting deflationary bust. What poor traders do not understand is that you must diversify long during inflation, and diversify short during deflation.

Concerning PMs, they are mostly dead metal, so even more so than real estate, they reflect the quantity of cash in circulation. So PMs are guaranteed losers during deflation, which is why so many people want to sell them to you. Worse still, Silver and Platinum are strong hybrid metals, with both precious and industrial characteristics. That kills their price even more as industry slows. Pt has collapsed; it has almost fallen to the price of gold.

All that is macro; the macro picture is easy and what most people should play--sell and hold, diversified--just the opposite of the inflationary epoch we recently exited. In the micro, I think we're nearing completion of a small, swift countertrend move in stocks, and might see the same in metals.

Unlike most traders (I'm guessing), I want to go way into the red here, to take advantage of low volume sales. I want to keep short selling, not buying; the more red I get in the short term, the more green I'll be in the long term. It's no different than any dealer taking orders short of supply, we want to sell at exorbitant prices and float the cash to do it, way way way in the red. I can't lose enough money right now.

Strong dollar is having a positive affect for equities. Everyone was waiting for the DXY to break out to put a chink in the armor of the equity market. The GLD is getting whacked appropriately but it seems that not all paper assets are the same. Would you recommend covering some of my GLD short and leaning harder on the equities short as the two come back together. I presume equities have to come down or GLD has to move up, unless equities are pricing in something I don't see? A stronger economy would support a stronger dollar and thus higher free market bond yields. The government can't handle higher bond yields, so what gives FDR?

Yes, I think equities are pricing in something that you don't see: the dollars used to price them. It makes me chuckle when people say a strong dollar is good for asset prices, it's a little like hoping to be the biggest turkey at Thanksgiving. If the dollar strengthens in buying power by about a penny, stocks priced in dollars fall about 1%. Pretty straightforward.

That said, exchange rates, as opposed to dollar strength or buying power, aren't as straight forward. Exchange rates depict the price of paper in terms of other paper, but that tells you nothing about the buying power of paper itself (see: Deflation and Exchange Rates).

If our current global deflation is a race to the bottom, then the relative positions of the cars represents exchange rates. If the Euro car was in the lead but falls behind, it doesn't matter, deflation still races along; all the cars are speeding in one direction. So the USD's rate of exchange in any given currency, or which car is making a move today, is meaningless to the outcome of a broad currency starvation. A global bonfire is burning bank cash of all domination's.

Most people intuitively understand the benefits of counterfeiting, because they have a debtor's mentality. They never stop to think about burning cash, as an equal or better scam for creditors. Burning cash is easy to do, never suspected, and if you can get enough people to owe you money first, an effective way to collect their assets.

To answer your questions:

No, I wouldn't buy equities. "Sell and hold" until 2012, minimum, still applies. Today, stock prices are about five times higher than record breaking (talking P/E, as the actual price). The macro picture for stocks, and business in general, is dire. Deflation will continue to drain all prices, as has been raging since Dec 2005 (real estate), Oct 2007 (stocks), and March 2008 (precious metals, with a very small-percentage countertrend overshoot in gold being the only exception). Prices are in collapse.

With individual equities, there is a small chance a certain stock price could move against the deflationary trend, but it has to sprint up the down escalator to do so. Rather than focus on finding a stock capable of out-pacing the liquidity squeeze, just diversify short. Diversification is the name of the game when you are trying to play an inflationary boom or the resulting deflationary bust. What poor traders do not understand is that you must diversify long during inflation, and diversify short during deflation.

Concerning PMs, they are mostly dead metal, so even more so than real estate, they reflect the quantity of cash in circulation. So PMs are guaranteed losers during deflation, which is why so many people want to sell them to you. Worse still, Silver and Platinum are strong hybrid metals, with both precious and industrial characteristics. That kills their price even more as industry slows. Pt has collapsed; it has almost fallen to the price of gold.

All that is macro; the macro picture is easy and what most people should play--sell and hold, diversified--just the opposite of the inflationary epoch we recently exited. In the micro, I think we're nearing completion of a small, swift countertrend move in stocks, and might see the same in metals.

Unlike most traders (I'm guessing), I want to go way into the red here, to take advantage of low volume sales. I want to keep short selling, not buying; the more red I get in the short term, the more green I'll be in the long term. It's no different than any dealer taking orders short of supply, we want to sell at exorbitant prices and float the cash to do it, way way way in the red. I can't lose enough money right now.

Buy Low; Sell High

Anon wrote: "could you write something about the BIG banks paying back TARP. One would think that this is very good , but something tells me something is rotten. Maybe they should have to realise every thing on their balance sheet to do so ?"

It's hard to get any real information about TARP, but I agree with you it is nothing but pure crime. The true beneficiary's exit strategy (since "the taxpayers" certainly aren't going to get a check in the mail) confirms we are at a major top.

Tuesday, December 8, 2009

Global Warming Fraud Reaches Frenzied Pitch

As if to race the air out of a ruptured balloon, the Obama administration seems desperate to force spiteful global warming legislation on a disgusted public.

The American people understand:

- Green plants crave a warm, carbon-rich environment. They breath pure carbon dioxide. The more carbon in the air, the greener our earth becomes.

- The Earth's temperature has plunged for the past 2 years. The temperature has dropped a full degree since Al Gore released An (incredibly) Inconvenient Truth. We're colder today than the year 1900.

- "Scientists" have been caught faking inconvenient data.

- Named hurricanes are on the endangered species list. Sometimes we don't get to "A."

- Certain states have special HOV lanes to encourage car pooling; other states tax HOVs for being inefficient.

- Ice is less dense than liquid water, when it melts the water level drops.

- Incandescent light bulbs were banned for dumping loads of carbon into the atmosphere; so do electric cars.

- A now hysterical climate change movement is emotional and irrational.

- It's about money.

Monday, December 7, 2009

Amateur Gold Traders Get it Backwards

It's dangerous to trade a market you don't understand. Those who do understand it easily confuse you into doing something stupid.

Gold is a current example. I hear the most ardent (brand new) gold bugs saying stuff that is completely wrong. One of the most obvious blunders has to do with Fed rates. Most first-time gold traders think low interest rates are positive for gold prices. Nothing could be more wrong. From 2002 to 2008, the gold price tripled because interest rates increased six-fold.

Gold is a current example. I hear the most ardent (brand new) gold bugs saying stuff that is completely wrong. One of the most obvious blunders has to do with Fed rates. Most first-time gold traders think low interest rates are positive for gold prices. Nothing could be more wrong. From 2002 to 2008, the gold price tripled because interest rates increased six-fold.Why?

Because interest rates are set by the free market, not by the Federal Reserve--let's get real. Climbing interest rates mean one thing: there is increasing demand for capital, and that only happens in an increasingly booming economy. Banks can raise interest rates for one reason and only one reason: people will pay it. ...when demand for bank cash is strong.

What does that have to do with gold prices?

Strong demand for bank cash = lots of bank printing = increasing paper cash supply = high prices for everything, including gold. Inflation. That is why the late 1970's inflationary debacle was accompanied, not by 0% rates, but by 22% interest rates.

I guaranty you that a hike in Fed rates will send amateur gold traders a sell signal. Since gold is currently a pumped band wagon, that's of lot of sellers. In fact, sustained climbing interest rates, a sign of intensifying inflation, are exactly what smart gold traders are attempting to anticipate.

Now, the truth is, any rate hike in the near future (before 2012ish) will be done for political reasons, it'll be counter market direction, and thus will become massively deflationary and laughably unsustainable. Such a foolish act in the face of no borrowing will result in a quick return to 0% interest rates, will intensify our global depression, and will drop prices even farther.

So in reality, this particular rate hike (not to be confused with genuine and sustained rising interest rates) will be bad for gold prices, along with all prices, because it will help bring down the house.

But amateur gold traders will have no idea why or what happened to them. They'll think higher interest rates are what crushed them. So they will miss the real golden opportunity to buy gold after the price has bottomed, when interest rates actually do begin to climb away from 0% in a sustained manner, indicating that there is increasing demand for inflationary bank cash.

Then again, that lesson is probably best passed to our children.

Sunday, December 6, 2009

Trillion Dollar Fraud

President Obama has proposed eliminating $1T in existing government fraud "to pay for" his Single Payer Universal Health Care plan. I've pointed out that this plan has two main objectives:

- Save Medicare (the largest financial crises we face as a nation, by far) by involuntarily reducing the number of old people.

- Generate enormous new debt and eternal interest payments to the bankers who run DC.

- Eliminate the Federal income tax (allow a vote on eliminating the Federal Income Tax vs. spending the same amount of money on Single Payer Health Care and see what happens).

- Give a $10,000 tax credit to every taxpayer to buy commercial health insurance for their families, enough to cover every American, not just the 10% uninsured.

- Give one round of Christmas bonuses to government-connected bankers (the last one cost $800B).

- According to feedthechildren.org, feed 2.8B children every year. Or, about 25% more children than actually exist on planet earth.

- Give every taxpayer a stack of vacuum-packed dollar bills, laid flat on top of one another, as high as they are tall.

Friday, December 4, 2009

Thursday, December 3, 2009

Drugs, Money, and the CIA in Afghanistan

I've been writing for quite some time that the U.S. government's (and the Russians, before us) objective in Afghanistan is the country's only valuable resource and singular point of interest: heroin.

How much heroin? Nearly every pound produced on the plant; a 95% monopoly. Try $500B street (2007) to likely $1T (est. 2009) retail value, annually, according to the UN. The country's total output has more than doubled since we began occupying it.

Bush = Obama. It doesn't matter. The CIA needs the drug money. You know, times are tough all over.

So tonight, I found it mildly interesting that MSNBC, a far-right, anti-Obama organization by all measures, is reporting that Obama's war in Afghanistan is not a war at all. In fact, MSNBC reports, there are almost double the number of "contractors" in Afghanistan (103,000) than U.S. military (44,000 and climbing) . Imagine that! I wonder why? It must be all the skyscrapers going up.

Further adding to the intrigue, Vanity Fair is reporting that Erik Prince, the CEO of the U.S.A's largest corporate "contractor" in Afghanistan, Blackwater Inc., has been outed (by guess who, surprise, a high ranking source in the U.S. military who doesn't like what is going on) as a full-time CIA operative. Prince denied it, right? Wrong. He confirmed that he is, in fact, "a CIA operative."

You heard it here first.

This is disgusting corruption at the highest levels. Yes, that means Obama and Bush. Who are cousins, in case you don't read this blog regularly (as is Dick Cheney, to both of them). MSNBC reported that too, after picking it up here.

We MUST start over.

Golman Sachs Loses Law Suit for Covering Up Subprime Exposure

Under threat of "significant court sanctions" and a probable flood of similar litigation, Goldman Sachs was forced to admit they have major exposure to subprime loans. Many will recall Lloyd Blankfien's public statement, as BSC and LEH collapsed (as I forecast, less than a year prior) that Goldman has no exposure to subprime, despite their own filings identifying some $53B in "non"-prime mortgages.

Ref:

Goldman Sachs mortgage sent couple into bankruptcy

SUCCESS: Company finally forced to reveal it actually held the paper.

According to the Anchorage Daily News, Goldman Sachs secretly tried to charge an Alaska couple $626,000 of sexed up charges on a 356,000 subprime mortgage. Judge Roger Efremsky crushed Goldman after finding out they were lying about not holding the subprime loan. Caught with their hand in the cookie jar, Goldman immediately lowered their subprime loan's interest rate to 5%, reducing the couple's monthly mortgage payments circuitously reaching Goldman Sachs, by 53%.

If your Goldman Sach's subprime loan is higher 5%, you should call them to see if they will honor the 5% precedent this case establishes.

Ref:

Goldman Sachs mortgage sent couple into bankruptcy

SUCCESS: Company finally forced to reveal it actually held the paper.

According to the Anchorage Daily News, Goldman Sachs secretly tried to charge an Alaska couple $626,000 of sexed up charges on a 356,000 subprime mortgage. Judge Roger Efremsky crushed Goldman after finding out they were lying about not holding the subprime loan. Caught with their hand in the cookie jar, Goldman immediately lowered their subprime loan's interest rate to 5%, reducing the couple's monthly mortgage payments circuitously reaching Goldman Sachs, by 53%.

If your Goldman Sach's subprime loan is higher 5%, you should call them to see if they will honor the 5% precedent this case establishes.

Wednesday, December 2, 2009

Sometimes Positions Cost money

Hello FDR,

Please know that I greatly respect you, and always appreciate all of the ideas, and posts that you write both on your blog and on marketwatch community.

Believe me when I say that I completely understand about deflation, and everything you have written on your blogs.

By looking at your portfolio on the Virtual Stock Exchange, I see that you have approximately 50% of the portfolio allocated to shorting gold and silver (25% each). Is this a coincidence or is it on purpose to be fully allocated to those positions??

Also, I know you are pretty convinced (as I am, too) that deflation is ravaging America, and lower prices will be reflected across the board. However, metals (gold and silver) keep defying all expectations and continue climbing. I understand that it is a bubble, that participants are so bullish (>95%) and everything. Nevertheless, at what point, if any, do you conclude that indeed higher prices might still be coming, it might be a good idea to close short positions and short again at some other levels??

I completely understand that your time horizon is bit extended and you can weather any storm, but, do you ever consider that possibility? I mean, do you reset positions? At what moments do you do so? For how long do you support (recommend supporting) the heat?

You wrote that your current stance is accumulation for the medium term? What happens to "losing positions" if before the price decline, price continues to increase? Isn't it more difficult to get back on track?

Please note that I'm not trying to be disrespectful at all. I still remember when you called for an oil top (in real time) at $134.50. It went up a little bit more to $147, but, then, it ended up crashing to $40. Do you something like this occurring to the PMs?

Sorry for the length of this message.

Hi,

Yes, I think metals will fall as hard as oil, but maybe not quite as far in terms of total percentage. The feel of the trade has become eerily similar.

I'm not worried about it at all. For one thing, I don't bet money I can't lose and still not have to go to work. The second thing is that I don't mind at all--in fact I hope for it--when a position I'm buying or shorting goes the other way. Think about it. If you were willing to be short or long at $X, and the stock goes the opposite way, you can lower your cost basis which is great! I don't understand people who get upset that their "investment" is going down, that's the way you want it to go initially.

Don't get hung up on today.

The reason my returns are bigger than most people expect, is because I don't mind putting money into a position, and they usually refuse. I can't count the number of puts and calls I've sold and bought with a 50% to 100% premium. That's ok, if you understand what you are doing. Does it both me? No. Of course not. Does it bother a casino mogul to blow $1B on an ornate property? A 100% loss up front?

Then again, most people buy or sell and pray; I don't do that. So it makes me more excited when the trade goes backwards, because I know it will go forward farther. I can't believe the deal I'm getting. I genuinely love it. People who buy and sell then hope for the best deserve to lose, and they ALWAYS do. Watch.

--

FDRAllOverAgain

Tuesday, December 1, 2009

Goldman Sachs Employees Get More Than They Bargained For

Or maybe the problem is that they didn't bargin, just stole from The People to stiff-arm bankruptcy court?

Whatever the reason, Bloomberg is reporting that Goldman Sachs employees are arming themselves to do battle against an outraged American public.

Somehow, I think the pencil-neck geeks at Goldman Sachs might suffer from a small firepower disadvantage as they face the brunt of the 2nd Amendment.

Oh well, all's well that ends well.

Friday, November 27, 2009

Holiday Market Update

Cashzilla Watch:

On the loose.

![[$zilla.png]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEj9Fsw6BzwIbEIsnYmcZouOhEw-9sIXkWeyYVVbmdOLjfw4-8sP2REwSExruk9LO1QkaHuIf_rMCRNFE3Bun4ztl8un8XeuBE0RoBGUnbIQv3V_3XJl6ikRjX4mWy88sZwHiqQPypSGDg/s1600/$zilla.png)

Stock Watch:

Today's market move was small but significant. Volume effectiv

ely doubled from yesterday. We will see an increasing slide to the downside as Wave 3 of C, the most powerful down-wave of the bear market, takes shape. I expect good downside returns for the remainder of 2009, but the beginning of 2010 should usher in heavier institutional selling.

CLICK TO ENLARGE

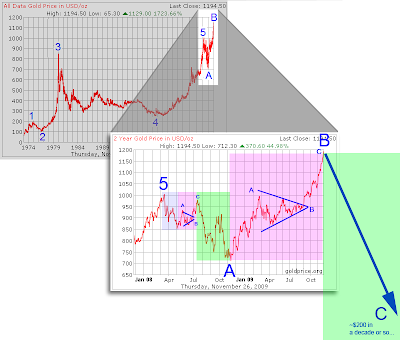

Gold Watch:

PM prices are being driven by the same liquidity bust as stocks, dying business, and plunging real estate; also causing our sharply rising dollar. Platinum has crashed. Silver is already 10% off its much lower highs from its all-time high of around $50. My 2020 gold target (illustrated below) is so far away in both time and $s that it is hard to estimate in other than broad terms. Gold should hit the previous 4 or slightly lower, in a time frame of a decade or two.

Note 1: EW triangles always precede the final leg of similar degree.

Note 2: The smaller degree A and B waves have been excellent fractal models for the recent larger scale waves. The small green area should provide a similarly accurate smaller scale fractal model for the larger degree C wave to come, which is also shaded green.

CLICK TO ENLARGE

Costco Watch:

Black Friday, 7:30pm - No lines; 50% open parking near the door; great deflated prices.

Unemployment Watch:

23% (counting those who've given up looking for work and have dropped off the dole; the BLS number only counts those receiving UE compensation) - We are currently 1% shy of the Great Depression's peak UE rate. Expect peak UE of approx 35%, assuming systemic stability. The "official" BLS number including all unemployed is 19%. 23% results from using the pre-Clinton methodology which is closest to the Great Depression method of simply counting our UE'd.

State Government Watch:

At least 10 States face imminent bankruptcy. They are, in order of total budget shortfall (= annual revenue - annual budget):

- California (-51%)

- Illinois (-49%)

- Arizona (-44%)

- Nevada (-41%)

- New Jersey (-32%)

- Wisconsin (-26%)

- Florida (-25%)

- Rhode Island (-23%)

- Oregon (-18%)

- Michigan (-16%)

- though State 47 are underwater

U.S. Government Watch:

The federal government also faces imminent bankruptcy:

$1.6T annual budget shortfall (-46%)

With UE growing at 1/2M+ per month from only 100M existing federal tax returns, the outlook for any state that is underwater and the federal government is dire.

U.S. Dollar Watch:

As forecast, the dollar is embarking on an rather extreme Wave 3 up, extending it's 21 month march higher (fat blue arrow, below).

Commercial lending, the driver of dollar value, continues to dry up and shut down. So few bank-printed dollars in circulation means each surviving $ buys more and more everyday. Sale prices (= the new permanent price) abound. Investors (as opposed to reckeless capital gains trader-speculators) can't get enough dollars.

Short term T-Bill yields? Nothin.

Look to pay negative Treasury yields within months, as a cascade of major bank failures entice tens of trillions currently placed with shaky banks to fight for tens of billions in Treasuries. Money not already through the Treasury window will be lost.

CLICK TO ENLARGE

Real Estate Watch:

As the private Federal Reserve buys up 85% of troubled MBSs for a few cents on the dollar, they can sell the backing assets (homes) for 5% of the 2005-2006 peak price and still double their money. Look for decreasing economic activity to slowly bring this option to fruition.

Would they rather sell for more? Sure. But they essentially have no cost basis for the huge quantities of real estate they are vacuuming up.

War Watch:

Our brave men and women continue to be exploited around the world to generate more egregious spending and thus unlimited interest profits for the debt makers.

It is a weekend to be thankful for the tremendous sacrifices made by our well educated troops, who do what they are told even as many recognize the cancer in Washington DC that uses and abuses them.

It is also a weekend to express outrage to our corrupt politicians of both parties who abuse their sacred covenant with our military. Our men and women signed up to support and defend our Constitution, not to support a $1T drug trade in Afghanistan; not to create a debt generation machine in Iraq; not to fight a faceless enemy to generate a wildly expensive, citizen-bothering DHS nanny state at home.

"War Tax" on the way to help crash markets and squeeze already poor people for more interest cash.

Portfolio Watch:

Portfolio Watch is now a few weeks old and accumulation for the medium-term downside is about set. A Special Report will go out to PW subscribers soon.

Thursday, November 26, 2009

Fractional Reserve Banking

"Anonymous said...

FDR - what is the history of fractional banking as it is practiced here in the US? Did it originate with the creation of the Federal Reserve or does it pre-date the Fed."

The quick answer is that fractional reserve banking dates to at least the Roman Empire, probably earlier. On a purely historical note, the most famous confrontation with Money Changers, those who make a living by subversively varying currency value at the expense of the people, was the crucifixion of Jesus. He overturned the tables of the swindlers who monopolized the Jewish Shekel to force the masses to pay marked-up exchange rates. Jesus was killed for doing so, a few days later.

Shekel - 400 B.C.

Shekel - 69 A.D. (Inflation at work?)

An early confrontation between

government-connected bankers and the people

But the modern day model of fractional banking, or Money Changing to scientifically engineer credit booms and deflationary busts for the exclusive profit of connected bankers, is a British export. The 1694 establishment of the Bank of England was the first fully functional sham outfit to use fractional reserve banking to pay royalty at the direct expense of her people.

To this day, central banks of the world follow the BoE model. It is why New York holds the concentration of US central bank swindlers and horse thieves--it is geographically closest to the king's bank, which never stopped siphoning US wealth. The BoE and the FBUS, SBUS, and now the Federal Reserve, were and still are one and the same institution, as are most other modern central banks hellbent on exploiting the good people of the world.

I'll point out, right now, that a continuously recycled trick in the BoE's "Create a Depression for Profit Playbook" is to slowly cycle onto and off-of a gold standard, to assure an outraged people that government action is being taken to "reign in" those wild bank speculators. Of course, the bank is the government and the government is the bank, as you will see, below. Cycling on a wavelength greater than a human lifetime helps the central bank foil attempts to uncover "their craftiness and tortuous tricks." (Otto von Bismark)

So the story goes, mid-evil Britain developed the principals of fractional reserve banking when goldsmiths leased-out unused space in their fortified bullion banks to store nobles' valuable possessions. The goldsmiths issued paper receipts for each deposit, "IOU one silver candlestick." Over time, people started trading the paper debt receipts instead of the objects themselves. And so, the gold-men became the first issuers of paper cash (side note--Marco Polo brought back paper currency from China in the 13th Century).

It is probably a timeless truth, spanning all corners of our globe, galaxy, and universe, that once paper IOUs start trading, depositors tend to leave physical wealth at the bank, and then it takes 15 minutes for a banker to stare quizzically at the pile of deposits, wondering, "why not put this idle wealth to work for me?" That Goldman might, say, use the silver candlestick to spice up his dinner table, just for a night or two. Or, he might wear another person's gem-encrusted gold ring for a while--or, perhaps--loan all this great stuff out to other people for a profit! (ding! ding! ding!) The money isn't his, but you know, if it is only "lent out" then he hasn't "technically" stolen it.

And so, fractional reserve banking, risking other peoples' money without their consent or knowledge, was born.

Money in circulation, owed to more than one person, and the bank-printed un-backed paper IOUs floated on top of known phantom deposits (pure, counterfeit cash), became the first inflationary paper. The amount of stuff the bankers didn't steal, to keep on hand to satisfy the small number of customers who occasionally claimed their stuff, was the bank's required reserve ratio. Bankers got rich counterfeiting their own paper IOUs, and honest people continue to pay for it via increasing quantities of un-backed, banker-printed, inflationary cash.

When the most powerful bank kingpins pay a cut of their counterfeiting profits to politicians to legalize and monopolize the scam, an odd creature known as a public-private central bank corporation is spawned (e.g. the privately held Federal Reserve banks).

This fun little story is exactly why I keep reiterating that "the government" has no ability to print cash, they cannot inflate, nor can they arrest deflation. Commercial banks, not the government, issue our entire cash supply, every penny of it, solely to generate private profit for themselves. Commercial banks, our Goldman, and only commercial banks can print paper cash for one, very good reason. It is the same reason people rob banks: that's where the money is.

Shekel - 69 A.D. (Inflation at work?)

[My note: Both coins clearly exhibit anti-coin-shaving designs. The 90 degree convex markings, and lip on the flip side of the older coin are intended to reveal if the diameter was reduced. The newer coin has writing nearly to the edge, plus a bimetal design that makes shaving the outer circumference less valuable than the coin's center. This proves that currency devaluation was well understood at least by the currency issuers. The greatest coin shaver of all time was President Lyndon B. Johnson, who shaved all United States silver coins to plated zinc, then returned them to circulation. As a result, today's circulated U.S. coins are completely worthless, making them as easy for the private Federal Reserve banks to inflate as paper cash.]

It is interesting, worth pondering today, that it was Money Changers, bankers who controlled the Roman government-corporatocracy, who had Jesus put to death."And Jesus went into the Temple of God and cast out all them that sold and bought in the Temple. And overthrew the tables of the Money Changers and said unto them, "It is Written, My House shall be called a House of Prayer; but ye have made it a den of thieves."

An early confrontation between

government-connected bankers and the people

But the modern day model of fractional banking, or Money Changing to scientifically engineer credit booms and deflationary busts for the exclusive profit of connected bankers, is a British export. The 1694 establishment of the Bank of England was the first fully functional sham outfit to use fractional reserve banking to pay royalty at the direct expense of her people.

To this day, central banks of the world follow the BoE model. It is why New York holds the concentration of US central bank swindlers and horse thieves--it is geographically closest to the king's bank, which never stopped siphoning US wealth. The BoE and the FBUS, SBUS, and now the Federal Reserve, were and still are one and the same institution, as are most other modern central banks hellbent on exploiting the good people of the world.

I'll point out, right now, that a continuously recycled trick in the BoE's "Create a Depression for Profit Playbook" is to slowly cycle onto and off-of a gold standard, to assure an outraged people that government action is being taken to "reign in" those wild bank speculators. Of course, the bank is the government and the government is the bank, as you will see, below. Cycling on a wavelength greater than a human lifetime helps the central bank foil attempts to uncover "their craftiness and tortuous tricks." (Otto von Bismark)

So the story goes, mid-evil Britain developed the principals of fractional reserve banking when goldsmiths leased-out unused space in their fortified bullion banks to store nobles' valuable possessions. The goldsmiths issued paper receipts for each deposit, "IOU one silver candlestick." Over time, people started trading the paper debt receipts instead of the objects themselves. And so, the gold-men became the first issuers of paper cash (side note--Marco Polo brought back paper currency from China in the 13th Century).

It is probably a timeless truth, spanning all corners of our globe, galaxy, and universe, that once paper IOUs start trading, depositors tend to leave physical wealth at the bank, and then it takes 15 minutes for a banker to stare quizzically at the pile of deposits, wondering, "why not put this idle wealth to work for me?" That Goldman might, say, use the silver candlestick to spice up his dinner table, just for a night or two. Or, he might wear another person's gem-encrusted gold ring for a while--or, perhaps--loan all this great stuff out to other people for a profit! (ding! ding! ding!) The money isn't his, but you know, if it is only "lent out" then he hasn't "technically" stolen it.

And so, fractional reserve banking, risking other peoples' money without their consent or knowledge, was born.

Money in circulation, owed to more than one person, and the bank-printed un-backed paper IOUs floated on top of known phantom deposits (pure, counterfeit cash), became the first inflationary paper. The amount of stuff the bankers didn't steal, to keep on hand to satisfy the small number of customers who occasionally claimed their stuff, was the bank's required reserve ratio. Bankers got rich counterfeiting their own paper IOUs, and honest people continue to pay for it via increasing quantities of un-backed, banker-printed, inflationary cash.

When the most powerful bank kingpins pay a cut of their counterfeiting profits to politicians to legalize and monopolize the scam, an odd creature known as a public-private central bank corporation is spawned (e.g. the privately held Federal Reserve banks).

This fun little story is exactly why I keep reiterating that "the government" has no ability to print cash, they cannot inflate, nor can they arrest deflation. Commercial banks, not the government, issue our entire cash supply, every penny of it, solely to generate private profit for themselves. Commercial banks, our Goldman, and only commercial banks can print paper cash for one, very good reason. It is the same reason people rob banks: that's where the money is.

Tuesday, November 24, 2009

Quick Cash Creation Review

First, please review:

Can the Fed Print Currency?

Bailouts Will Never End

"When the Federal Reserve creates money which the Treasury then issues Treasury notes, bills and bonds AND the Fed buys back these same Treasuries they are essentially creating monies from thin air - "quantitative easing" - is the euphemism isn't it?"

Yes, of course, assuming there is never any tax collection to pay back principal owed plus interest.

The main point is that you have to primarily consider the REAL cash printers which are the commercial banks printing with 40X speculative leverage on top of Fed reserves. That is, reserves wholesaled to them when Fed rates are BELOW the retail 3-M T bill rate. In other words, when Fed reserves are cheaper than the market rate and any loan, even simple arbitrage or carry, will produce a profit.

Today, Fed reserves are 1200% more expensive than the market rate for short term cash, so the REAL money printers are slamming on the brakes. There is nothing the gov or the Fed can do to arrest deflation. They can pull on the string, but they can't push if there are no commercial borrowers. And there are none.

Bernanke was schooled the hard way over the past two years, M3 has plummeted while he has tried everything his childlike academic theories claimed would work. None of his ideas have worked. Like I said the day he was appointed, that is EXACTLY why Ben was selected for the Fed Gov Chair....

Fed shareholders knew Bernanke was an arrogant die hard inflationist with zero market experience. He published prolifically that he would make the identical mistakes to 1929 (even better--his analysis was that they didn't do ENOUGH). They knew he would wind up crashing the cash supply due to bankruptcy, unemployment and (taxpayer guaranteed) loan defaults. Such a deflation = unlimited profits for them.

The last sentence, above, is the most important one.

The essential mistake people make is that they think the privately held Bank of NY (aka The Federal Reserve) is part of our government, and thus on their side, rather than reality of the situation which is that the Fed is doing everything in their power to ruin the American people.

The Fed wants your wealth. Period. And your childrens' wealth. And your little dog, too.

Inflation and Precious Metals

The year 2000 usered in our first deflationary crises in decades; the first really serious one since 1930. Today's crises is technically a continuation of the same crises, as most stocks and indexes continue in down channels established in Y2K. GM, for example, hit its high of $96 in Y2K, and only recently went bankrupt and is liquidating now, close to $0.

Strangely, the fad of today is PMs. All the cab drivers are buzzing about them. I've posted a lot about why this is the worst time to own PMs, especially if one is foolishly chasing capital gains, as over-liquidity is drying up at a record pace.

Interestingly, PMs, as a group, are doing very poorly. One has to look back to the last inflation crises, when the cash supply was ballooning out of control and the interest rate to coax people into holding dollars was on a rocket. That was under Jimmy Carter.

Those who remember the first legal right turn on red (implemented to save fuel), the crises in Iran, a decaying US military that couldn't rescue a hostage without turning back after taking heavy losses, probably also remember 22% interest rates and the effect it had on people. What a contrast to today...

That was inflation.

I remember my parents planning to buy all their non-perishables, en mass and as quickly as possible to avoid next month's price hikes. Anything we were sure to use was bought forward--appliances, canned food, toilet paper. "Creative financing" was the real estate buzz phrase, as heavy demand drove up prices despite 20% mortgage rates. Everyone owned a gold fund, sophisticated investors owned a handful of miners, as a recommended fraction of mainstream investment portfolios for the previous 20 years. If you could find a station with gas, the line was shorter than a half mile and your last license plate digit matched the even/odd day, you hopped in it.

An ounce of gold bought the Dow.

Silver was $50 an ounce. It bought 25 movie theater tickets to see Star Wars.

That was inflation.

Monday, November 23, 2009

Bloomberg Gets it Right

“We cannot spin a positive story from the fact that a third-of-a-trillion dollars a week is trying to lock down Treasury bill yields of less that 0.05 percent,” Bianco said. “There is still tremendous demand for the front end of the curve despite the fact that people are saying things like there is no yield there and that cash is trash.” -Bloomberg, Nov 23

Add a record shattering S&P 500 P/E ratio of and you get the picture. We sit at the cusp of a massive continuation of the greatest market crash in human history. If P/Es land in their historic recovery range of 6 to 8, the S&P will dip below 50 in the coming decades (assuming companies' earnings stay inflated).

NY Times Predicts Much Larger Stimulus Bill

The NY Times is predicticting another stimulus bill and much higher debt levels, as the only solution for the deepening depression--ooops, I mean--the long gone, backdated recession.

The last stimulus bill (which followed the $trillion banker bonus stimulus) was "way too small" to work, they say.

Saturday, November 21, 2009

Universal Health Care--Neuter the Revolution

I maintain UHC is about one thing: killing as many seniors and otherwise inconvenient citizens as possible. This is murder, plain and simple. The only way to solve our government's grandiose, $70T Medicare over-reach is to kill those to whom we've promised too much.

I'm sorry to report this isn't a joke, but the explicit, unstated intent of the United States government. If ever there was a reason to keep our corrupt government out of Life, Liberty, and the Pursuit of Happiness, this rotten bill to amputate our elderly is it.

We have none other than Putin to thank for the most successful single-payer Universal Health Care model yet devised. The Russian population is projected to fall from 175M in 2004 to fewer than 80M by 2015, with a particularly brutal assault on males. The average life expectancy of a Russian male is between 51 and 58 years, depending on who you believe.

With luck, and a lethal dose of a drug-toting corporatocracy, the USA can achieve the same or better.

We'll finally be rid of our elderly and miscellaneous unfit dead weight; no more Medicare/Medicaid debate, only the productive will be left turning cranks for global socialite fat-cats. Our already emasculated male population will be similarly targeted for destruction; just try to raise an army to fight for your freedom.

Socialist financiers, hellbent on seizing our wealth and lancing the irritating boil of commoner freedom, seem to have learned from history. Have we, the people?

Inflation vs. Deflation (Again)

Let's ignore the fact that deflation has already dominated all markets (including precious metals, sans gold which has been driven sideways for the past 20 months), and look at the two flations a little different way.

It strikes me that holding one of the two viewpoints boils down to a single fundamental stance: socialist vs free marketeer.

The socialist believes that markets are easily engineered, thus, governments or central banks will simply print cash altruistically, thus all prices will rise. Socialists see no need for, and no effect of, human emotion or self interest, so policy alone drives prices.

The free marketeer believes that people usually act in their own self interest creating inescapable market forces, and in the end market forces dominant policy.

So the flation points of view are adopted by these camps in the following two ways:

- Socialists believe when the politicians say lend, banks lend and all prices rise.

- Free Marketeers believe when politicians say lend, no one listens to politicians so prices do what prices will do.

I'm sure a lot of people will say, hey, I'm no socialist, but I know when central banks print money. To that I respond in advance, if one truly believes policy is the ultimate driver of markets, then whether you acknowledge it or not, you are, in fact, a Kool-aid drinking socialist. I know that's inflammatory, I want it to be. I'm genuinely disturbed by a 97% "gold bull" reading when governments "tell people" they are going to inflate prices.

I hope a lot of people reflect, instead of simply react.

The truth has already ravaged all markets: real estate, stocks, bonds, businesses, precious metals, commodities. But the worst has yet to be imagined at the punch bowl. Until the 97% majority chuckles at inept policy makers, who've never produced a dime, claiming to have total power over global capitalism, the USSA will continue to tumble and crumble.

Thursday, November 19, 2009

3-M T-Bill Hits 0.005%--Fed Rate 50x Higher

The Fed rate always matches the 3-M Treasury.

That's because the Federal Reserve Corporation, which is just another name for the private Bank of NY, wants to steal as much money from the American public as possible. They have to. The Fed has a legally binding, fiduciary duty to their mostly-foreign shareholders to swindle US citizens.

Fed Bank of NY map shows 2/3rd's (65.8%) of US mortgages were late in the last 12 months (as of August 2009). Current policy forbids lending to those with a late mortgage payment in the last 12 months.

Fed Bank of NY map shows 2/3rd's (65.8%) of US mortgages were late in the last 12 months (as of August 2009). Current policy forbids lending to those with a late mortgage payment in the last 12 months.Since the Fed only "lends" (against no backing deposits) for 30 to 60 days, the Fed rate should be less than the 3-Month Treasury. Let's call their excessive interest rate another tax on you, since your government is in bed with the private Fed, and that is what permits their banking monopoly.

"Huh?" says John Q, "I thought the Federal Reserve Bank of NY determined interest rates?"

No, that's wrong.

That any bank can arbitrarily determine the global rate for venture cash is, without a doubt, the dumbest thing I've ever heard. Not surprisingly, virtually every economics professor, consuming our valuable oxygen, believes this borderline-hilariousness bunk to their very core.

Interest rates are fully determined by global U.S. Treasury auction. Interests rates are set, exclusively, by Free Market action.

How could any sane person not realize that the global market determines the interest rate the people of planet Earth will accept for cash loans? One would almost have to incur a $half-million in legally unforgivable student loan debt, for an ivy league university indoctrination, to think otherwise.