Astute readers of

The Answer is Simple, Volume understand that price information without volume information is indeterminate. As government stats roll in, I'll go ahead and ask the obvious question that main stream economists don't seem to have the insight to ask, "Who cares?"

Where to start? How about, who cares about the

BLS CPI? The BLS homepage purports:

The most widely used measure of inflation, the CPI is an indicator of the effectiveness of government policy. In addition, business executives, labor leaders and other private citizens use the index as a guide in making economic decisions.

Translation: People who do not understand markets look at the CPI. Price alone tells us nothing about "effectiveness" and it gives no useful information to decision makers. The reason is buried in the flawed methodology:

The CPI represents changes in prices of all goods and services purchased for consumption by urban households.

The flaw is the word "purchased." By counting only completed sales, the index becomes price trivia, not price information--the price the last guy paid instead of the price the market will bear.

Imagine the Millionaire Sentiment Index (MSI), it surveys millionaires to determine how many intend to spend more on goods and services in the future. The headline trend looks promising:

Millionaire Sentiment Index (MSI)

Millionaires Intending to Spend More

2007 - 67%

2008 - 72%

2009 - 88%

The economy is booming, right? Wrong. No volume. That is covered by the MI:

Millionaire Index (MI)

Number of Millionaires

2007 - 3.8M

2008 - 3.2M

2009 - 2.1M

By measuring only the purchase price, the CPI leaves out the more critical number of how many things were not purchased. Same reason stock volume generally moves counter-trend during corrections from the primary trend. The price paid in a relatively small number of deal closures is, virtually by definition, the wrong price or more deals would close.

Why do government bureaucrats report on market prices instead of reporting on markets? Because if they understood markets, they wouldn't be bureaucrats.

Then there is propaganda. Sellers hate discounted prices for obvious reasons. They want you to think other people are willing to pay high prices (or they wouldn't hold "sales" in the first place) so the CPI inherits the same agenda:

The prices used to calculate the index are the regular cash prices in effect, including all taxes directly associated with the purchase and use of the items.

As if to compensate for the CPI's failings, we have GDP, which is equally useless because it only considers the flow volume:

GDP = C + I + G + (X − M)

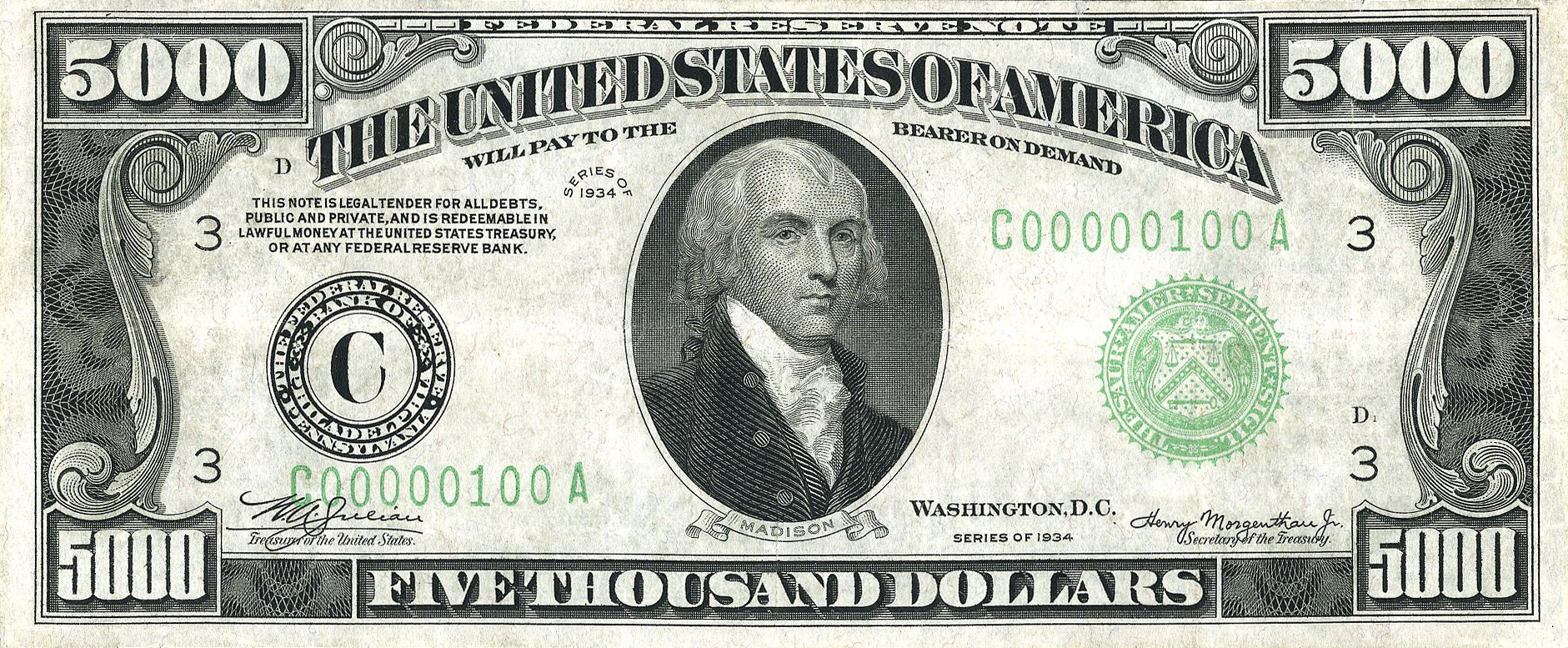

The guy in the middle is scratching his head because academicians and bureaucrats scratch themselves too. Generally speaking, neither group understands markets, which again, is why they are disinclined to participate. What good is measuring the volume of dollars without knowing prices? If we blow the entire money flow on the inflated price of a single paper clip, our entire GDP amounts to a single paper clip, no matter how many dollars changed hands. The opposite happens when prices are low.

To illustrate the flaw, let's examine GDP today vs. the Great Depression. People who study the Great Depression are horrified that GDP contracted 50% over the course of the collapse. The Great Depression was worse than our condition today, right? Not so fast. In the 1920's and 30's the dollar's value was pegged to gold. This mitigated the affects of inflation and deflation in a way that is not in place today. Guess what happened to the gold price during their crash? Of course... nothing, the dollar was pegged.

What about now?

During our so-called "boom years" from 2002-2007, we had the opposite GDP phenomenon. We had a fairly steady GDP, but gold prices tripled. So our "boom" saw GDP

contract by about 2/3rds, if measured the exact same way they measured during the Great Depression. If that was the boom, I can't wait to see the bust.

Then there are revisions. Revisions should never be permitted in any reliable statistic (shouldn't that be obvious?). If you discover more of something later, it should fall into the appropriate "later" report. Revisions happen because bureaucrats are risk averse. By allowing revisions they can trail reality instead of reflect reality. 20/20 hindsight allows them to be "right' more often, because they never take a stance in the first place.

During the real estate plunge, heavy handed, consistently revised (always in the same direction, oddly: down) government data

killed businesses that foolishly relied on correspondingly tainted computer models. Companies like investment banks routinely made decisions based on rosy data that was later revised way down, it was too late to revise the decision down. Statistics allowing revisions are not helpful, they are harmful.

Then there are the government's black boxes. The Birth/Death model, seasonal adjustments to indexes, unidentified and/or arbitrary assumptions. These are different. These "fixes" are actually designed to spoil the data when it might be accurate. These are the "labor unions" of statistics, they want to curb peaks in value so they can't be held to the same high standard in the future. No one knows exactly what most of these things do, because no one wants to know, you see, if we knew, we would also know when we don't know, and then we would have to know all the time, but we can't know all the time, because we never knew how we found out.

The solution to these recurring statistical fumbles? Cut the Federal propaganda budget to $0.

Private FDIC insurance, plus FDR's promise of an unlimited government backstop if the bank's couldn't pay their insurance premiums, was set up to partially reimburse people when banks lost our deposits in ultra high leverage, wildly risky speculative schemes.

Private FDIC insurance, plus FDR's promise of an unlimited government backstop if the bank's couldn't pay their insurance premiums, was set up to partially reimburse people when banks lost our deposits in ultra high leverage, wildly risky speculative schemes.

![[BailOut-400.png]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiOamSroPyQeEWbByXaUBdMz3-ZiOxTvrFXMAsVeDAwSkcOfl4DHrTxFJ0webHz4Lv7URrtMYXZq1KLDBn-QZaFXGVWrC8J-3TsqK8GYYuo7dQCfI6udG6TgZNOzxoKfvzO8hEx_M5kcQ/s1600/BailOut-400.png)