Insurance beneficiary:

Doing what must be done to stay covered:

A medical screening:

Many were able to choose their own doctor:

Children that benefited from automatic coverage;

a. Not change2.) Citi stock goes to $0, at the same time IBM announces a new CEO and rises 4%, the Dow:

b. Drop 360 points

c. Drop 180 points

d. Drop 712 points

a. Goes up

b. Goes down

c. Stays the same

a. 3

b. 115

c. 50

d. 200

a. 135 points

b. 410 points

c. 40 points

d. 1,200 points

a. 240 points

b. 30 points

c. 300 points

d. 90 points

a. Alcoa + BofA + Citi+ GE + Intel + Kraft + Pfizer = IBM

b. J&J = Kraft

c. Citi + BofA = JP Morgan Chase

d. Caterpillar + Chevon + Disney = Exxon

a. Tomorrow it is weighted less8.) How many of the original Dow components are still part of the Dow?

b. Tomorrow it is weighted more

c. Tomorrow it is weighted the same

a. 0

b. 1

c. 7

d. 12

a. True

b. False

a. The Dow will not changeI added one more question to clarify a comment...

b. The Dow goes up 50 points

c. The Dow goes Down 50 points

a. Go up to 11,240

b. Go down to 10,400

c. Not change

"The sheer magnitude of Citigroup's operations, and the company's history of receiving extraordinary government support, has led this panel to an inescapable conclusion: The United States government will bear any burden and pay any price to ensure that Citigroup does not fail" --Elizabeth Warren, chairwoman of the congressional oversight panel

WARNING: This blog contains views that are often unconventional. That's because "conventional wisdom" is designed to take your money

DISCLAIMER: This blog may make specific forecasts, nothing is guaranteed so trade at your own risk. Some content might offend organizations created for the sole purpose of stealing other people's money. If you are offended by the content of this blog, don't read it (and stop stealing other people's money)

Issued May 2007 - Short real estate, home builders, bond insurers and leveraged financials

Current Target - Ongoing declines

Issued Oct 2007 - Conservative investors go 100% cash and Treasuries

Next target - Two years of physical cash in home; Ladder short to medium term US Treasuries with the rest; Minimize bank account balances, CDs, and non-treasury bonds; associate high paying bond yields with capital starvation

Issued Oct 2007 - Short Dow (14,100) and broad market indexes

Next Targets:

by 2012 - Dow 3,800

then - as high as Dow 6,000

by 2025 - Dow 800

Issued Oct 2007 - Short Automakers and Airlines

Next Target - More declines, many luxury makes go the way of Duesenberg

by 2020 - pain

Next Target - Gold $475, other PMs with proportionate or greater declines

By 2020 - Gold $225

Next Target - $25

by 2020 - $4

Relentless DEFLATION

Increasing US Dollar buying power as measured by falling real estate prices, stock prices, most asset prices, and falling treasury yields; Periods of excessively negative 3 month treasury yields

Continued transfer of taxpayer funds, high yield preferred stock, risky loan guaranties, and asset holdings to the Federal Reserve and connected bankers in the face of taxpayer clamor; result: increased strain on commercial and consumer credit accelerates deflation

Main Stream Media to continue promoting Federal Reserve and banker agenda: more debt, more debt, more debt

5,000+ bank failures

More bank consolidations intended to shift FDIC insurance obligations to common stockholder losses

FDIC bailout/restructuring that compromises insurance payouts

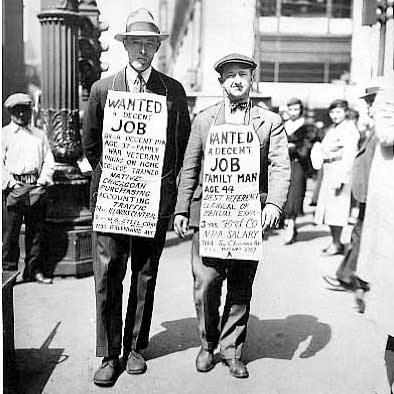

Massive "New Deal 2.0" in order to transfer maximum wealth from the poor (taxpayers) to the Federal Reserve, connected bankers and corporations, and to benefit politicians; result: same as the original New Deal, economic depression

Supreme Court Increased to 11 Justices by 2015, unless the conservative majority yields first

Higher mileage vehicles go cheap and dirty, not expensive and "Green"

Continuation of 2007+ global cooling