Cashzilla Watch:

On the loose.

![[$zilla.png]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEj9Fsw6BzwIbEIsnYmcZouOhEw-9sIXkWeyYVVbmdOLjfw4-8sP2REwSExruk9LO1QkaHuIf_rMCRNFE3Bun4ztl8un8XeuBE0RoBGUnbIQv3V_3XJl6ikRjX4mWy88sZwHiqQPypSGDg/s1600/$zilla.png)

Stock Watch:

Today's market move was small but significant. Volume effectiv

ely doubled from yesterday. We will see an increasing slide to the downside as Wave 3 of C, the most powerful down-wave of the bear market, takes shape. I expect good downside returns for the remainder of 2009, but the beginning of 2010 should usher in heavier institutional selling.

Gold Watch:

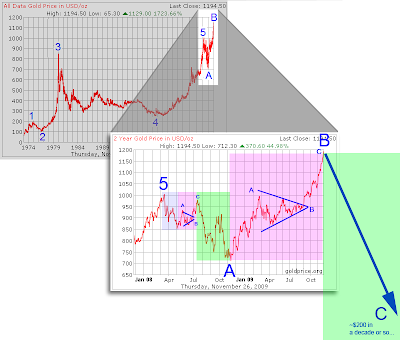

PM prices are being driven by the same liquidity bust as stocks, dying business, and plunging real estate; also causing our sharply rising dollar. Platinum has crashed. Silver is already 10% off its much lower highs from its all-time high of around $50. My 2020 gold target (illustrated below) is so far away in both time and $s that it is hard to estimate in other than broad terms. Gold should hit the previous 4 or slightly lower, in a time frame of a decade or two.

Note 1: EW triangles always precede the final leg of similar degree.

Note 2: The smaller degree A and B waves have been excellent fractal models for the recent larger scale waves. The small green area should provide a similarly accurate smaller scale fractal model for the larger degree C wave to come, which is also shaded green.

Costco Watch:

Black Friday, 7:30pm - No lines; 50% open parking near the door; great deflated prices.

Unemployment Watch:

23% (counting those who've given up looking for work and have dropped off the dole; the BLS number only counts those receiving UE compensation) - We are currently 1% shy of the Great Depression's peak UE rate. Expect peak UE of approx 35%, assuming systemic stability. The "official" BLS number including all unemployed is 19%. 23% results from using the pre-Clinton methodology which is closest to the Great Depression method of simply counting our UE'd.

State Government Watch:

At least 10 States face imminent bankruptcy. They are, in order of total budget shortfall (= annual revenue - annual budget):

- California (-51%)

- Illinois (-49%)

- Arizona (-44%)

- Nevada (-41%)

- New Jersey (-32%)

- Wisconsin (-26%)

- Florida (-25%)

- Rhode Island (-23%)

- Oregon (-18%)

- Michigan (-16%)

- though State 47 are underwater

U.S. Government Watch:

The federal government also faces imminent bankruptcy:

$1.6T annual budget shortfall (-46%)

With UE growing at 1/2M+ per month from only 100M existing federal tax returns, the outlook for any state that is underwater and the federal government is dire.

U.S. Dollar Watch:

As forecast, the dollar is embarking on an rather extreme Wave 3 up, extending it's 21 month march higher (fat blue arrow, below).

Commercial lending, the driver of dollar value, continues to dry up and shut down. So few bank-printed dollars in circulation means each surviving $ buys more and more everyday. Sale prices (= the new permanent price) abound. Investors (as opposed to reckeless capital gains trader-speculators) can't get enough dollars.

Short term T-Bill yields? Nothin.

Look to pay negative Treasury yields within months, as a cascade of major bank failures entice tens of trillions currently placed with shaky banks to fight for tens of billions in Treasuries. Money not already through the Treasury window will be lost.

Real Estate Watch:

As the private Federal Reserve buys up 85% of troubled MBSs for a few cents on the dollar, they can sell the backing assets (homes) for 5% of the 2005-2006 peak price and still double their money. Look for decreasing economic activity to slowly bring this option to fruition.

Would they rather sell for more? Sure. But they essentially have no cost basis for the huge quantities of real estate they are vacuuming up.

War Watch:

Our brave men and women continue to be exploited around the world to generate more egregious spending and thus unlimited interest profits for the debt makers.

It is a weekend to be thankful for the tremendous sacrifices made by our well educated troops, who do what they are told even as many recognize the cancer in Washington DC that uses and abuses them.

It is also a weekend to express outrage to our corrupt politicians of both parties who abuse their sacred covenant with our military. Our men and women signed up to support and defend our Constitution, not to support a $1T drug trade in Afghanistan; not to create a debt generation machine in Iraq; not to fight a faceless enemy to generate a wildly expensive, citizen-bothering DHS nanny state at home.

"War Tax" on the way to help crash markets and squeeze already poor people for more interest cash.

Portfolio Watch:

Portfolio Watch is now a few weeks old and accumulation for the medium-term downside is about set. A Special Report will go out to PW subscribers soon.

FDR I trust the yesterday you refer to is the 25th? That volume increase is interesting as today had two fewer trading hours than Wednesday. Also I didn't think there was anyone else accept me and a few devout Prechterites who thought markets could continue dumping into year-end. Nice.

ReplyDeleteFDR, what would you say to a handful of smart investors that truly believe the end game here is to destroy the value of the US dollar and create a new world currency? If this is the case, your suggestion of investing in the US Dollar would not be wise. It's hard to beat the FED, with Ben hell bent on avoiding deflation. Looking forward to your reply.

ReplyDeleteOops, maybe I should return those gifts I purchased today.

ReplyDelete"FDR, what would you say to a handful of smart investors that truly believe the end game here is to destroy the value of the US dollar and create a new world currency? If this is the case, your suggestion of investing in the US Dollar would not be wise. It's hard to beat the FED, with Ben hell bent on avoiding deflation. Looking forward to your reply."

ReplyDeleteSome might remember when the Fed started their rate cutting campaign and I said the market would tank even harder. The Dow plunged from 14K to 6.5K while the Fed cut rates. The Fed always loses.

It's actually extremely easy to beat the Fed--or--they are really doing the opposite of what they say they are doing. You pick, but the Fed's advertised position always gets creamed by the market.

You say the FED always loses. That contradicts a lot of your stuff here about how money changers have mastered the art of stealing the peoples money. If they always lose they would have been broke a long time ago. Isn't the reason we still deal with them today because they always win?

ReplyDelete"You say the FED always loses. That contradicts a lot of your stuff here about how money changers have mastered the art of stealing the peoples money."

ReplyDeleteIt's not a contradiction. The Fed publically says they exist to give away free cash so everyone makes money. Yet, the opposite of what they say they are doing is what always happens:

They said they were cutting interest rates to prop prices; prices crashed.

They said they were dumping liquidity into markets for the past two years; M3 crashed.

Either A) It is trivial to beat what they say they are trying to accomplish.

or B) They don't really exist to give away free money; they exist to steal your money.

You pick.

FDR Checked the volume and I cannot see how you are getting the effective double. Yahoo finance shows lower volume for both DJIA and SPX on Friday. No quarrel on future direction though.

ReplyDeleteFor a half day...

ReplyDeletehttp://www.zerohedge.com/article/case-depression-dollar-collapse

ReplyDeleteFDR- I still don't understand why the dollar has to be worth anything at the end of day, even if they are being destroyed by loan default and you can't get your hands on any? How would a transition to another currency work? What would happen to our existing currency and those that hold it? If the DXY is sitting at 60 next year is the dollar still strong because of the deflation that will ensue, or would the DXY at 60 mean inflation is here? What do you use to measure the strength of the dollar, any particular index? At what price are you looking for that particular index to hold in order to still be in the dollar strengthening camp?

ReplyDeleteyou said you've read "human action". i'm sure you'll remember that mises states that there are no constants in human action. this seems to be in direct contradiction with these waves (about which i know nothing admittedly), which purport to give a repeated constant pattern of how lots of individuals in the market will act. do you think mises is wrong?

ReplyDeleteRegarding the link above--it's a great recap of how most people are confused and why they've lost so much money from Dow 14,000.

ReplyDeleteFirst of all, if one expect the USD to collapse, you should be mega-leveraged long in real estate and stocks, and should have been that way since the collapse started in 2006 (RE) and 2007 (stocks).

So immediately, you know these guys have no clue because they expect both a USD devaluation AND prices to fall. Those two outcomes are mutually exclusive.

It's like saying you expect everything in Walmart to go on sale because prices are about to go through the roof. It is nonsensical.

Consider how confused the author is, he says:

"The value of a currency is determined by a number of variables."

That is silly. The value of a currency is trivial to determine. It is the amount of paper in circulation divided by the amount of assets (money; wealth) that paper represents. It is trivial precisely because they are no variables.

Next, he says...

"The dollar has enjoyed a boost in demand and an exchange rate premium due to its privileged role as the world's reserve currency. "

What?

Who ponders philosophical points when they are buying and selling? No one.

The reason the dollar has SOARED in value over the past 21 months (contrary to all news) is the simple equation I mentioned above:

There are fewer dollars in circulation relative to assets. Period. Nothing else will cause a dollar to buy more. Commercial banks aren't printing. They can't. Or they'll lose what they print. Credit is exhausted--there are no profitable borrowers.

No bank profit? No cash for you.

No bank cares a hoot about what is the "official reserve currency of planet earth" when they consider underwriting a loan with their printing press. All they care about is if they'll recover their leveraged capital plus interest. If the answer is commonly no, then all prices are going to fall from currency starvation.

It's simple.

Thank you FDR. Soothed again by your simple understanding of it all

ReplyDeleteThat is silly. The value of a currency is trivial to determine. It is the amount of paper in circulation divided by the amount of assets (money; wealth) that paper represents. It is trivial precisely because they are no variables.

ReplyDeletethis is known as the quantity theory of money, and is refuted in "human action". the demand to hold cash (hoarding as the keynesians like to call it) enters into the determination of the purchasing power of money.

the fact that foreigners demand dollars to hold (as reserves), increases the dollar's purchasing power.

"this is known as the quantity theory of money, and is refuted in "human action"."

ReplyDeleteThat really doesn't bother me. Using currency to represent assets (money) is a simple concept.

Consider any counterfeiter introducing new cash--the effects are easy to determine. Banks are no different.

"FDR- I still don't understand why the dollar has to be worth anything at the end of day, even if they are being destroyed by loan default and you can't get your hands on any? How would a transition to another currency work? What would happen to our existing currency and those that hold it?"

ReplyDeleteSure, the $ can theoretically become worthless. But we'd have to change our monetary system to make that happen to something like the Wiemar, where the government issues cash. In our debt-based monetary system, credit extension (new debt issue) is solely an act to generate commercial profit. So currency issue cannot happen without a profitable borrower. Every single penny of currency in circulation is the result of a loan, a debt.

The US government doesn't print cash, only banks do. That is why, over the course of at least 6 intense depressions since America was formed, we've never experienced any inflation at all. Zero. They've all been severely deflationary.

Inflation is purely a by-product of prosperity when banks issue 100% of a debt-based currency pool for profit.

"How would a transition to another currency work? What would happen to our existing currency and those that hold it?"

ReplyDeleteProbably like other countries that've transitioned to new currencies. I don't see why we would do that when the dollar is getting more valuable everyday. Prices are falling, disastrously so for those in debt, which is most business, as they've grown accustomed to prosperity-driven commercial currency inflation.

If you are in debt, you want the dollar to become worthless. So many people are praying for that right now, so their debt will go away, that there is no way on God's green earth it can happen.

If you are not in debt, you want the dollar to buy more, so prices fall around you. That is happening as debt issue driving liquidity dries up. You are about to get wealthy by doing basically nothing.

Hello FDRA,

ReplyDeleteGreat to see that you are posting once again.

Instead of asking about the "dollar collapse" (that topic has been thoroughly explained and settled long time ago thanks to your superb writings and examples on the subject), I would like to ask about Silver Prices.

Do you also expect them to behave very similarly to the price of gold?? Do they also have their own "fractal equivalences"?

Being completely honest, I think this fractal graphs you have presented are completely awesome, and something I would like to further research. Do you have any recommended readings or guidelines to analyze and determine fractals???

Thanks a lot.

"I would like to ask about Silver Prices.

ReplyDeleteDo you also expect them to behave very similarly to the price of gold?? Do they also have their own "fractal equivalences"?"

Similarly? Yes. Silver, like all PMs has its own characteristic but interlocking fractal waves. The more you explore, the more you'll see how different waves distort and bend, but still interlock in a way that makes sense.

Silver never reclaimed it's late late 1970's inflationary highs, unlike gold. There are lots of reasons. I think the main reason is it's increasing use as an industrial metal. Platinum too, has established itself as an industrial metal. Gold, not so much.

As a hybrid PM/industrial metal that shot up way too high (during both the late 70's and early 00's) based partly on high commercial expectations that were dashed, I expect silver to crash harder than gold in the coming years.

Silver is like the NASDAQ of PMs.

As far as books on fractal trading, forget them. Fractal trading is a waste of time without first understanding how to interpret the basic price patterns.

The key is understanding both Elliott's essential insight on what patterns to look for and how they must repeat before changing direction, in addition to understanding how nature's fractals continuously scale over time to build all sorts of complex, but also surprisingly simple things.

The best book is the only one that simply reproduces R.N.E's own writings. All the interpretations fall short of his fundamental genius, so for the most part, I recommend doing your own interpreting:

http://www.elliottwave.com/books/rn_masterworks/default.aspx?code=oco

(no affiliation)

Also note that RNE wrote his words down way before the term "fractal" was coined or understood. Basically, Elliott discovered fractals, but he didn't realize the usefulness of his discovery spanned many fields of science.

King World News Broadcast

ReplyDeleteA new interview with Robert Prechter, few days ago.

FDR- I believe we will take out the March lows, but I also believe you arevery early in calling another top. I think you first thought 9500 was the top, now 10500 area. I think we trade closer to 11000 by year end and maybe 12000 by March, then colapse. Friday was a great trap for the shorts again who are all calling another top here I believe.

ReplyDeleteYou mention our brave young men and women being exploited. It only reminds of the fact that china has no military presence anywhere and yet they reap the benefits of the us military. Is this how the US is repaying them for the weak dollar, in blood.

ReplyDeleteWhy are they getting contracts in Iraq? I am sure they are making out like bandits in other countries courtesy of the US.

Yet there is no mention of this fact in public, is there.

Hi

ReplyDeleteGreat information.

- J.

Web Solutions

FDR Are you familiar with Steve Keen and his lonely war on neoclassical economics? His latest article is a real gem.

ReplyDeletehttp://debtdeflation.com/blogs/